- Joined

- 21 April 2005

- Posts

- 3,922

- Reactions

- 5

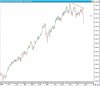

Re: XJO--What if the majority are wrong?--Maybe this isnt the top!

I totally agree Mr Gorilla.

I copped a gaping wound today with ANZ. Total of 3 positions offloaded all together.

They all gapped down...horribly is a subjective term. But unless you are short or waiting to be short no gap down can be contrued as a positive thing.

I was more or less waiting for this moment to reassess what I was doing anyhow. In equities a purge of the portfolio from time to time can be a good thing

I totally agree Mr Gorilla.

I copped a gaping wound today with ANZ. Total of 3 positions offloaded all together.