Re: XAO Analysis

Vishalt,

That is just being silly to compare the XAO to the Nikkei - it is like comparing a pitbull to a sausage dog, totally different animals and breeds.

Please - you can do better than argue this.

Is that so?

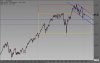

Take a look at that abomination ^^ a.k.a Japan's 225 Nikkei average.

Imagine you held those blue-ship shares of a country who had once a "world model" of an economy, 17 years past that and you still have a stock market that's nearly 26,000 points down from that day. And joy for those folks still holding as Japan as on the verge of ANOTHER recession.

Ofcourse maybe in another 20 years it might finally get back up, or maybe not, but geez, long wait, I guess they've already passed those shares onto their kids or grandkids though.

Even the major Euro markets (FTSE, Dax) haven't broken past their all-time highs since the tech bubble burst!

But I'm guessing they'll just take a LOT more time and really - who wouldn't be frustrated at waiting for those to get back lol

Vishalt,

That is just being silly to compare the XAO to the Nikkei - it is like comparing a pitbull to a sausage dog, totally different animals and breeds.

Please - you can do better than argue this.