Re: XAO Analysis

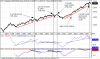

We are above the 38% level and nearing the 50% level on this pullback from it's most recent high. Note the dominant candle, (dominant candles must have high volume as apposed to a long candle). Anybody who is a keen candle fan will know that the open close and middle part of these candles can often be areas of support or resistance, price is near this level. We also have a 26 day ema, notice it has acted as support and resistance several times on this chart. And I won't forget to mention the head and shoulders neckline. After observing and trading these patterns over the years I have found they will usually do one of two things, either drop like a stone from around here, after spending a short amount of time near the neckline, and that time could be slightly above or below the neckline or may start ranging in that area for a while before heading in either direction. There is also an internal trendline which I haven't added where the price is now sitting under.

I used to post charts using internal trendlines for I have found them valuable at times but if someone feels like being a critic they can't resist to reply about such a line and I didn't want to clutter the chart with every thing I see. All charts in log scale. Cheers

Uncle Festivus, Thanks for your reply and top chart. I have to admit I look at the monthlies sometimes even though I trade off the dailies, would also like to add 1 hour and 5 minute charts to the collection, one day. Cheers

We are above the 38% level and nearing the 50% level on this pullback from it's most recent high. Note the dominant candle, (dominant candles must have high volume as apposed to a long candle). Anybody who is a keen candle fan will know that the open close and middle part of these candles can often be areas of support or resistance, price is near this level. We also have a 26 day ema, notice it has acted as support and resistance several times on this chart. And I won't forget to mention the head and shoulders neckline. After observing and trading these patterns over the years I have found they will usually do one of two things, either drop like a stone from around here, after spending a short amount of time near the neckline, and that time could be slightly above or below the neckline or may start ranging in that area for a while before heading in either direction. There is also an internal trendline which I haven't added where the price is now sitting under.

I used to post charts using internal trendlines for I have found them valuable at times but if someone feels like being a critic they can't resist to reply about such a line and I didn't want to clutter the chart with every thing I see. All charts in log scale. Cheers

Uncle Festivus, Thanks for your reply and top chart. I have to admit I look at the monthlies sometimes even though I trade off the dailies, would also like to add 1 hour and 5 minute charts to the collection, one day. Cheers