>Apocalypto<

20.03.2012

- Joined

- 2 February 2007

- Posts

- 2,233

- Reactions

- 2

Re: XAO Analysis

great post nick, you show clarity in the panic.

much enjoyed and appreciated.

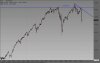

Nizar depending on the next rally and how it fairs to the sellers. I am also looking for higher low or divergence to get in long. I personally think the market is changing it's behavior. I don't think it's changing for the better either! time will tell can't be one sided in any picture no matter how one sided it seems.

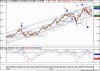

Bullish interpretation anyone...

This post may contain advice that has been prepared by Reef Capital Coaching ABN 24 092 309 978 (“RCC”) and is general advice and does not take account of your objectives, financial situation or needs. Before acting on this general advice you should therefore consider the appropriateness of the advice having regard to your situation. We recommend you obtain financial, legal and taxation advice before making any financial investment decision.

great post nick, you show clarity in the panic.

much enjoyed and appreciated.

Nizar depending on the next rally and how it fairs to the sellers. I am also looking for higher low or divergence to get in long. I personally think the market is changing it's behavior. I don't think it's changing for the better either! time will tell can't be one sided in any picture no matter how one sided it seems.