Hi Penn,

Further deterioration in some regional indices calls into question whether short-term lows are nearby. Australia and Hong Kong continue to decline steeply. India is at a critical juncture where a rally is required to maintain the intermediate-term bullish trend.

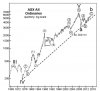

The ASX 200 broke lower today and as I write futures continue to slide to new lows this night.

The brief sideways correction last week counts best as a fourth-wave triangle as shown on the intraday chart, though smaller time frame subdivisions are not a triangular waves so this count is questionable. If you notice the RSI index below does not show any positive divergences that should be typical for 5th waves, so I should be cautios about labeling it as a first wave down which implies a temporary bottom and rally ahead starting this week.

My discipline tells me to avoid picking bottoms during steep declines, especialy when the trend in momentum indicators remains bearish.

The Australian market is extremely weak here. When looking at the weekly, we can see that recent decline is so powerfull, that it instantly reached the 5 year RSI uptrend line-a good spot to stop and start a rally.

iF this week closes lower it tells me that this medium term uptrend is broken. This event will immediately puts us to longer term timeframes which are very very messy and unclear.

But for now let's see whether this decline is over as a first wave (circled), because if it is, it should rally almost immediately tomorrow, unless market decide to sport a small Ending Diagonal as the (v) wave.

One more note-because market is oversold short-term, failure to relieve a pessimistic presure will usually result in a crash. I am monitoring a US markets(and the rest of the world as well) and they seem to be in a juncture of either crash or rally, I can't see any sideways from here in US.

Tommorow I'll post more charts and thoughts... Cheers

Further deterioration in some regional indices calls into question whether short-term lows are nearby. Australia and Hong Kong continue to decline steeply. India is at a critical juncture where a rally is required to maintain the intermediate-term bullish trend.

The ASX 200 broke lower today and as I write futures continue to slide to new lows this night.

The brief sideways correction last week counts best as a fourth-wave triangle as shown on the intraday chart, though smaller time frame subdivisions are not a triangular waves so this count is questionable. If you notice the RSI index below does not show any positive divergences that should be typical for 5th waves, so I should be cautios about labeling it as a first wave down which implies a temporary bottom and rally ahead starting this week.

My discipline tells me to avoid picking bottoms during steep declines, especialy when the trend in momentum indicators remains bearish.

The Australian market is extremely weak here. When looking at the weekly, we can see that recent decline is so powerfull, that it instantly reached the 5 year RSI uptrend line-a good spot to stop and start a rally.

iF this week closes lower it tells me that this medium term uptrend is broken. This event will immediately puts us to longer term timeframes which are very very messy and unclear.

But for now let's see whether this decline is over as a first wave (circled), because if it is, it should rally almost immediately tomorrow, unless market decide to sport a small Ending Diagonal as the (v) wave.

One more note-because market is oversold short-term, failure to relieve a pessimistic presure will usually result in a crash. I am monitoring a US markets(and the rest of the world as well) and they seem to be in a juncture of either crash or rally, I can't see any sideways from here in US.

Tommorow I'll post more charts and thoughts... Cheers