Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

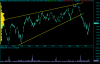

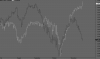

Thought I would add some observations. The G.C. Lane Stochastic Oscillator places value on the close price and this Stochastic representation shows the relationship between XAO lows and the Stochastic Oscillator over recent years. Getting near that Stoch. low now it does appear along with past resistance level 5200. The DOW closed near low on Saturday morning with around 500 points shed over the past two sessions. More down here yet I assume.