Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,376

- Reactions

- 11,737

Your EW based 4550 target indicated here didn't quite work out. What's next? We must be in a new wave now?Hello all, I will post my view using EW as I trading/investing purely by using this method.

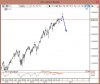

First of all I would like to mention that 2007-2009 crash was in Three Waves witch is important because 3 Waves usually means a correction. But looking at the long term charts (spaning decades), these 3 Waves are very short in terms of time.

So what market can do is to make a double Three correction W, X and Y, where each Wave consists of Three Waves. I marked these W and X Waves as a circled Waves, so what is missing is another 3 Waves Down at Primary Degree to new lows (below 2009).

I think we are at the very important juncture now, as you can count 5 Waves from 2011 low complete or almost complete, which will end Intermediate Wave (C). Also, it looks like from the mid 2013 market is forming an Ending Diagonal (ED), a pattern where all internal subdivisions consists of three Waves and ED usually means a swift reversal to the bottom of where the pattern started, in this case to 4600.

This is a probability only, to pick the exact top is very difficult. We still don't have 5 Waves down at least in a Daily Chart, this would be a confirmation of a trend change. Also, if you look at the weekly RSI, it is still in the Trend Mode-bouncing every time when correction ends. If it brakes lower in the coming weeks, it will make a further rally very unlikely, It worth looking at this.

On a bullish side you can see that 61.8% level was broken which is actually bullish, I remember the same action when I traded in US markets and DOW JONES did the same thing late 2010 and kept rallying afterwards to new ATH.

So things to watch is weekly RSI and the wave structure on a Daily. I sold all my positions last week and now need a confirmation from the market-what it will do next. Later I will post an alternate bullish count, but at this stage I am sceptical about it. US markets have fallen in Five Waves down from the top, it could drag down the whole world indexes later .