- Joined

- 25 July 2008

- Posts

- 383

- Reactions

- 5

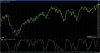

SPI 2 hourly chart. Fib retracement line and stochastic oscillator. Looks to be some bullish divergence close to triggering.

I'm hoping that this concludes an ABC correction to the downside and a resumption of the uptrend. Perhaps the Aussie can jump on the Shanghai coat tails and onwards and upwards?