You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

XAO Technical Analysis

- Thread starter Sean K

- Start date

- Joined

- 19 January 2011

- Posts

- 100

- Reactions

- 1

Re: XAO Analysis

http://www.marketwatch.com/story/fe...h/marketpulse (MarketWatch.com - MarketPulse)

It will fall even lower if the US decides to really end the QE2, fasten your seatbelt

http://www.marketwatch.com/story/fe...h/marketpulse (MarketWatch.com - MarketPulse)

It will fall even lower if the US decides to really end the QE2, fasten your seatbelt

- Joined

- 11 September 2008

- Posts

- 844

- Reactions

- 0

Re: XAO Analysis

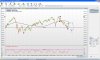

Sounding like a broken record here but still positioning for a bounce around the corner. Type A bullish (previously type C) divergence is now forming:

Also 10 day adv/decline is showing bullish divergence, however, this is just holding up.

Unfortunately I'm not seeing any confluence of patterns with individual stocks in the market. Therefore I haven't got any pending conditional orders. A rejection of weakness from here would provide me with a few set-ups.

No advocating that we are going to get a great bounce, but I would be looking for a move make up 4790 to then look for weakness to set in again. Market is too oversold to short from here.

Well that's my game plan for the following weeks

Sounding like a broken record here but still positioning for a bounce around the corner. Type A bullish (previously type C) divergence is now forming:

Also 10 day adv/decline is showing bullish divergence, however, this is just holding up.

Unfortunately I'm not seeing any confluence of patterns with individual stocks in the market. Therefore I haven't got any pending conditional orders. A rejection of weakness from here would provide me with a few set-ups.

No advocating that we are going to get a great bounce, but I would be looking for a move make up 4790 to then look for weakness to set in again. Market is too oversold to short from here.

Well that's my game plan for the following weeks

- Joined

- 11 September 2008

- Posts

- 844

- Reactions

- 0

Re: XAO Analysis

NASDAQ bounced nicely off support (will post a chart when I get home). If today holds I'll be scanning for long set ups tonight.

NASDAQ bounced nicely off support (will post a chart when I get home). If today holds I'll be scanning for long set ups tonight.

IFocus

You are arguing with a Galah

- Joined

- 8 September 2006

- Posts

- 7,569

- Reactions

- 4,639

Re: XAO Analysis

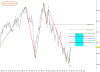

measured moves , rinse and repeat . range repettion brings us down near 4370 , buyers just on holidays atm . march lows finally hit and definate key support from here .

On daily we have lost channel support so that still looks bleak . daily support aligns with the hourly range so im liking that for swing low potential on daily . we got opex this week and that pivot into that wont surprise .

measured moves , rinse and repeat . range repettion brings us down near 4370 , buyers just on holidays atm . march lows finally hit and definate key support from here .

On daily we have lost channel support so that still looks bleak . daily support aligns with the hourly range so im liking that for swing low potential on daily . we got opex this week and that pivot into that wont surprise .

Attachments

- Joined

- 11 September 2008

- Posts

- 844

- Reactions

- 0

Re: XAO Analysis

Getting close to a 3 month grind down now with volatility slowly dissappearing . I think we need a decent flush (exhaustion) still to get a sustained recovery . not much point in a chart as we havent really changed much in the entire month of june . daily holding at march lows but im fairly sure the stops below need to be run before a rally , im sure a lot are building and the support level will seem the area to define risk for many . im fairly market neutral atm and have been trading fx a bit as there is a more defined trend . anyway march lows key downside and the downsloping trendline resistance key for upside movement , between those 2 reference points there is a little range trading and not much else . below march lows the range down 2nd quarter 2010 comes into play . be careful out there ................

ps a very astute trader i know is looking for 4122 on cash 200 (xjo) , im keeping an eye on it

Getting close to a 3 month grind down now with volatility slowly dissappearing . I think we need a decent flush (exhaustion) still to get a sustained recovery . not much point in a chart as we havent really changed much in the entire month of june . daily holding at march lows but im fairly sure the stops below need to be run before a rally , im sure a lot are building and the support level will seem the area to define risk for many . im fairly market neutral atm and have been trading fx a bit as there is a more defined trend . anyway march lows key downside and the downsloping trendline resistance key for upside movement , between those 2 reference points there is a little range trading and not much else . below march lows the range down 2nd quarter 2010 comes into play . be careful out there ................

ps a very astute trader i know is looking for 4122 on cash 200 (xjo) , im keeping an eye on it

- Joined

- 28 March 2006

- Posts

- 3,565

- Reactions

- 1,304

Re: XAO Analysis

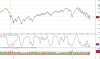

Possibility that we may be approaching an area of support as highlighted below if the 4500 or thereabouts area doesn't hold up.

Pretty much in no mans land at the moment, waiting for the next piece of the jigsaw which may be next week in the new FY.

(click to expand)

Getting close to a 3 month grind down now with volatility slowly dissappearing .

Possibility that we may be approaching an area of support as highlighted below if the 4500 or thereabouts area doesn't hold up.

Pretty much in no mans land at the moment, waiting for the next piece of the jigsaw which may be next week in the new FY.

(click to expand)

Attachments

nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

Re: XAO Analysis

The good news is we are higher this year than we were in July 2010. Also we bounced after 2 July 2010 when the reporting came in better than the write downs of the gfc.

The bad news is we need to bounce from here or the xao will continue to track down to 4350 and then possibly 4250. If it doesn't find support at 4250, you don't want to know where the next support level is.

The good news is we are higher this year than we were in July 2010. Also we bounced after 2 July 2010 when the reporting came in better than the write downs of the gfc.

The bad news is we need to bounce from here or the xao will continue to track down to 4350 and then possibly 4250. If it doesn't find support at 4250, you don't want to know where the next support level is.

Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

Re: XAO Analysis

I'm observing a reluctance for buy and hold at this point in time. Appears to me that there are participants wishing to unload on any price appreciation. A pause before further declines maybe. Am buying so not pessimistic in view. Will see soon enough if 4500 remains.

I'm observing a reluctance for buy and hold at this point in time. Appears to me that there are participants wishing to unload on any price appreciation. A pause before further declines maybe. Am buying so not pessimistic in view. Will see soon enough if 4500 remains.

- Joined

- 24 January 2011

- Posts

- 98

- Reactions

- 0

Re: XAO Analysis

Hi guys,

Anyone think that it is now the end of the retracement or there are more to go down? DJIA went back above 12200 yesterday and stock futures suggesting another small run tonight and XAO has also just hit downtrend line today and stock futures suggest more upward movement tomorrow. Can someone experienced please post a proper analysis to agree or disagree with my view.

Thanks

Hi guys,

Anyone think that it is now the end of the retracement or there are more to go down? DJIA went back above 12200 yesterday and stock futures suggesting another small run tonight and XAO has also just hit downtrend line today and stock futures suggest more upward movement tomorrow. Can someone experienced please post a proper analysis to agree or disagree with my view.

Thanks

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

Re: XAO Analysis

First signs of life since March/April on our market. That's how I see it.

Amongst the specs, a lot of strong looking bounces off lows, but may only have another 5-10% in them.

AORD had a double bottom, obvious on the recent chart. Today was a breakout from that with a possible target of 4760. I feel that a half strength move, (ie. 4700) is much more likely. The other thing about 4700 is that it's the big parallel trend line break - returning for a look see.

There will be a few stocks with strong opens tomorrow. A lot of money has been sitting out of the speccies since April, and the next few days should see some pretty decent runners in the 10-30% range. Won't last long though, IMO. I'll be 100% exposed tomorrow (up from 25%).

First signs of life since March/April on our market. That's how I see it.

Amongst the specs, a lot of strong looking bounces off lows, but may only have another 5-10% in them.

AORD had a double bottom, obvious on the recent chart. Today was a breakout from that with a possible target of 4760. I feel that a half strength move, (ie. 4700) is much more likely. The other thing about 4700 is that it's the big parallel trend line break - returning for a look see.

There will be a few stocks with strong opens tomorrow. A lot of money has been sitting out of the speccies since April, and the next few days should see some pretty decent runners in the 10-30% range. Won't last long though, IMO. I'll be 100% exposed tomorrow (up from 25%).

Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

Re: XAO Analysis

Yes agree Gringotts with a solid follow through today but cautious all the same.

Yes agree Gringotts with a solid follow through today but cautious all the same.

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

Re: XAO Analysis

Good to see it break through 4640 if only just. Hard to work out whether todays action was a case of improved market sentiment and buyers coming back in or a case of brokers closing out their end of fiscal year positions to get their bonuses.

The Greek Parliament has passed their austerity measures, Euro Bankers are committed to bailing out Greece. Our own reserve banks has come out and indicated it will support the big 4 banks if there is a melt down in Europe.

Resources bounced again today which is supposed have a good flow-on effect to the rest of our economy, unemployment is still below 5% and the Reserve Bank is keeping the lid on interest rates which reduces the likelihood of defaults on local mortgages. In other words the housing bubble isn't going to burst tomorrow so we should improve from here.

If the xao can move up to the next resistance level of 4788 without retracing I'll be happy and will start buying again. If the gains prove to be false and it retraces I'll wait for the next bottom.

Good to see it break through 4640 if only just. Hard to work out whether todays action was a case of improved market sentiment and buyers coming back in or a case of brokers closing out their end of fiscal year positions to get their bonuses.

The Greek Parliament has passed their austerity measures, Euro Bankers are committed to bailing out Greece. Our own reserve banks has come out and indicated it will support the big 4 banks if there is a melt down in Europe.

Resources bounced again today which is supposed have a good flow-on effect to the rest of our economy, unemployment is still below 5% and the Reserve Bank is keeping the lid on interest rates which reduces the likelihood of defaults on local mortgages. In other words the housing bubble isn't going to burst tomorrow so we should improve from here.

If the xao can move up to the next resistance level of 4788 without retracing I'll be happy and will start buying again. If the gains prove to be false and it retraces I'll wait for the next bottom.

- Joined

- 28 March 2006

- Posts

- 3,565

- Reactions

- 1,304

Re: XAO Analysis

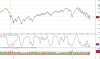

Agree, if it turns south between 4700 and 4760 there could be another leg down.

(click to expand)

If the xao can move up to the next resistance level of 4788 without retracing I'll be happy and will start buying again. If the gains prove to be false and it retraces I'll wait for the next bottom.

Agree, if it turns south between 4700 and 4760 there could be another leg down.

(click to expand)

Attachments

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

Re: XAO Analysis

My analysis has it that there's another 20 points left to this rally, which won't happen today, but maybe over the next 1-2 days, finishing at 4715. I've done my trades, back in cash and will look for some 'late stage' rally kind of stocks (ie. unpopular stocks running on unexpected good news).

My analysis has it that there's another 20 points left to this rally, which won't happen today, but maybe over the next 1-2 days, finishing at 4715. I've done my trades, back in cash and will look for some 'late stage' rally kind of stocks (ie. unpopular stocks running on unexpected good news).

Similar threads

- Replies

- 31

- Views

- 4K

- Replies

- 141

- Views

- 33K

- Replies

- 9

- Views

- 5K

- Replies

- 22

- Views

- 14K