tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,454

- Reactions

- 6,521

Re: XAO Analysis

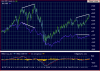

There are strong resistance technical setups which have come into play in all the RUSSELL

DJI

and NASDAQ.

With all 3 correlating strongly and the steady decline over the past few sessions-- I feel we may see only corrective up moves in a new down thrust if price falls past old resistance levels (which should act as support).

We have one on the XJO at 4600. Trading below here and it wont be nice.

I'm not happy either with my portfolio profit dissolving 50% this morning.

So 4600 the key here.

What's going on on the US markets that has you worried tech?

There are strong resistance technical setups which have come into play in all the RUSSELL

DJI

and NASDAQ.

With all 3 correlating strongly and the steady decline over the past few sessions-- I feel we may see only corrective up moves in a new down thrust if price falls past old resistance levels (which should act as support).

We have one on the XJO at 4600. Trading below here and it wont be nice.

I'm not happy either with my portfolio profit dissolving 50% this morning.

So 4600 the key here.