Whiskers

It's a small world

- Joined

- 21 August 2007

- Posts

- 3,266

- Reactions

- 1

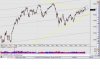

Re: XAO Analysis

Yeah, I'm still happy with a Diag Triangle pattern for 'i' up, rather than a corrective Triangle... but as I mentioned I think I was a bit premature with my 'b', given that I am looking for a larger degree correction.

Given the EW experts say a wave two correction is often short and sharp, although one would usually associate that with a zig zag, it looks to me like a stock market correction will be more a currency based/triggered realignment to the trade and curency wars than any other fundamentals, hence the reason I use the rubber band analogy for an Expanded Flat correction.

Can you pls post up a chart? I would've thought your wave C would be a move up?

I think he's referring to chart in post 8361 above aren't you whiskers?

Yeah, I'm still happy with a Diag Triangle pattern for 'i' up, rather than a corrective Triangle... but as I mentioned I think I was a bit premature with my 'b', given that I am looking for a larger degree correction.

Given the EW experts say a wave two correction is often short and sharp, although one would usually associate that with a zig zag, it looks to me like a stock market correction will be more a currency based/triggered realignment to the trade and curency wars than any other fundamentals, hence the reason I use the rubber band analogy for an Expanded Flat correction.