- Joined

- 5 March 2008

- Posts

- 951

- Reactions

- 141

Re: XAO Analysis

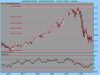

Considering the rally from the IR cuts lasted a grand total of 6 minutes after the announcement, and about a hour before the announcement and we are about 37 points down on the spoos, it doesn't look like the cat will be bouncing tomorrow.

and we are about 37 points down on the spoos, it doesn't look like the cat will be bouncing tomorrow.

In fact tonight maybe the time to assume the crash position. The PPT maybe out of ammunition.

The PPT maybe out of ammunition.

brty

Considering the rally from the IR cuts lasted a grand total of 6 minutes after the announcement, and about a hour before the announcement

and we are about 37 points down on the spoos, it doesn't look like the cat will be bouncing tomorrow.

and we are about 37 points down on the spoos, it doesn't look like the cat will be bouncing tomorrow.In fact tonight maybe the time to assume the crash position.

brty