Re: XAO Analysis

I'm talking short term

NAB CBA WBC ANZ were lower and have been moving sideways since roughly July and are holding above the lows despite the market breaking further to the downside. I am surprised they are holding above their lows. Perhaps people running to the banks for safety? Little do they know

Um I'm not that blind froggy to miss the last 12 months - 4 years of action. I have been trading the ranges in the current market.

Um I'm not that blind froggy to miss the last 12 months - 4 years of action. I have been trading the ranges in the current market.

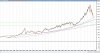

not sure how you see see 4050points up over 4 years and down 3150 in the next year as 'holding up well' mo

I'm talking short term

NAB CBA WBC ANZ were lower and have been moving sideways since roughly July and are holding above the lows despite the market breaking further to the downside. I am surprised they are holding above their lows. Perhaps people running to the banks for safety? Little do they know