Re: XAO Analysis

brty,

When you decide to answer my questions that I've repeatedly asked of you, I might consider answering yours.

Hi,

Dhukka,

What is random???

How can it be that yesterdays market action that affects the actions of many market participants today, be regarded as 'random' in any shape or form??

The factors that affect stock movements are many and varied, but thinking it is random is a mistake.

A coin toss is a separate event from the last toss, the coin does not have a memory, that is random.

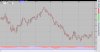

The market behaves in ways that can by measured by probabilities according to past events. On any occasion the bet can be wrong. A 50/50 system can be a huge winner if you are prepared to cut the losses immediately while aiming for much larger winners. Failure to understand that, and just pick on the bad calls, means a lack of understanding of the game.

We all make many predictions/bets everyday, with high probabilities on our side. For instance, whenever you drive your car, you are betting that the guy in the car coming the other way, will stay on his side of the road. Most of the time that prediction/bet is successful, but for some it is the wrong bet, that has happened to me.

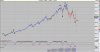

Your theory of having a coin toss vs market picking direction for the following week is a silly idea, because my choice is up every week. Past history will show you that the indexes have a positive bias over the long term. Your random coin toss will lose.

brty

brty,

When you decide to answer my questions that I've repeatedly asked of you, I might consider answering yours.