theasxgorilla

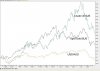

Problem solved... next bubble.

- Joined

- 7 December 2006

- Posts

- 2,343

- Reactions

- 1

Re: XAO Analysis

Sounds ominous...what is a trap move exactly?

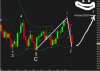

You can see a trap move from the bottom of this congestion

Sounds ominous...what is a trap move exactly?