chops_a_must

Printing My Own Money

- Joined

- 1 November 2006

- Posts

- 4,636

- Reactions

- 3

Re: XAO Analysis

We are obviously going to get a retest of that breakout point. Any thoughts or targets if it doesn't bounce off?

Following on from the analysis of the XAO was posted -090208

https://www.aussiestockforums.com/forums/showpost.php?p=258027&postcount=2842

https://www.aussiestockforums.com/forums/showpost.php?p=258028&postcount=2843

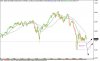

The following EW chart was shown with the expected pattern of trend shown by the arrows. The target was 6244pts and the date 11th March as the preferred time cycle count and 21st march as the alternate.

So far the pattern of trend has traced out as expected and pink wave b of the contracting triangle has completed and pink wave c is currently in progress. These usually retrace 50-61% of wave c. Not much else has changed, this is a countertrend rally and should be fully retraced when it is complete and I expect market to continue on to fresh lows.

The SP500 has also a similar pattern of trend

Cheers

We are obviously going to get a retest of that breakout point. Any thoughts or targets if it doesn't bounce off?