The news right now seems to be very bullish. The Motley Fools is still preaching about ASX6000 and that this is just a minor pause and the bull movement is still strong.

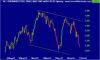

The price action looks weak to me. It looks like the XAO is at the very least ranging (and it looks like if it is ranging it's reached the top of the range and swinging down). At worst it's signifying the end of a trend. The prior higher low has been taken out and it's fell short of a new high. If this were a stock you probably wouldn't be jumping on to go long here.

I am at least short term bearish (next week or two) on the XAO and I am trying to get out of the habit of shorting and going long stocks in the same index. I don't think this makes sense. I have only two long trades in the ASX right now and I am out if they don't open higher. I really don't want anything to do with long positions right now. Of course I am putting my money where my mouth is and taking out shorts. If I think going long is wrong, going short must be right. We get the advantage of seeing the US trade first though, yay for long weekends.

The price action looks weak to me. It looks like the XAO is at the very least ranging (and it looks like if it is ranging it's reached the top of the range and swinging down). At worst it's signifying the end of a trend. The prior higher low has been taken out and it's fell short of a new high. If this were a stock you probably wouldn't be jumping on to go long here.

I am at least short term bearish (next week or two) on the XAO and I am trying to get out of the habit of shorting and going long stocks in the same index. I don't think this makes sense. I have only two long trades in the ASX right now and I am out if they don't open higher. I really don't want anything to do with long positions right now. Of course I am putting my money where my mouth is and taking out shorts. If I think going long is wrong, going short must be right. We get the advantage of seeing the US trade first though, yay for long weekends.