tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,447

- Reactions

- 6,477

Agree we are nowhere near overbought.

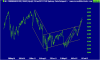

Do you make anything of the divergence which has occurred over the last month?

View attachment 50621

Longer term lines disrespected. Shorter term lines holding. Top of channel.

And if that doesn't hold.... there's always another line somewhere.

Time for some new tools?

Plenty of tools here on ASF

Time for some new tools?

Plenty of tools here on ASF

That is one lip smacking sweet looking trend!

But we are not in isolation

TradeTheNews.com Asian Market Update: Nikkei soars on new lows in Yen - Source TradeTheNews.com

Your squiggles make money?

Nah mate I just do this for hobby. One day I hope to be a pro, I'll then be able to quit my job packing shelves at night in the Frankston Coles.

you know what I mean yeah?

You'll get there. Just keep at it.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.