tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,447

- Reactions

- 6,477

Treat it as a paper trade

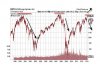

FTSE 100.

I don't trade CFD'S

I'd closed the z

Was on I pad used the FTSE 100

Should have been more thorough.

Well spotted though.

FTSE 100.

I don't trade CFD'S

I'd closed the z

Was on I pad used the FTSE 100

Should have been more thorough.

Well spotted though.