- Joined

- 9 June 2011

- Posts

- 1,926

- Reactions

- 483

Agreed J it looks really strong.

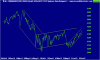

Daily is still just a sequence of h/highs and h/lows. On the the 30 min the reversal bar from Sep 27 looks like a beacon and it has just run up from their.

Interested to get your thoughts on the week ahead when you get a chance. On a longer term basis that 4500 level has been a 'busy' zone and it wouldn't surprise me if we hung around here for a little bit or perhaps had a slight pull back.

Not sure what markets/indicators you keep an eye on in regards to helpful hints on how the XJO will play out but one interesting thing for me was the heavy action last Friday.

Note the heavy volume on the major constituents and it rained true for all the major stocks in the index that day. Wouldn't surprise me if we did re-test that 4370-4390 level (on the XJO) at some point and then had the buyers come back in?

Gotta dance until the music stops I guess so keep buying those dips??!!!

Daily is still just a sequence of h/highs and h/lows. On the the 30 min the reversal bar from Sep 27 looks like a beacon and it has just run up from their.

Interested to get your thoughts on the week ahead when you get a chance. On a longer term basis that 4500 level has been a 'busy' zone and it wouldn't surprise me if we hung around here for a little bit or perhaps had a slight pull back.

Not sure what markets/indicators you keep an eye on in regards to helpful hints on how the XJO will play out but one interesting thing for me was the heavy action last Friday.

Note the heavy volume on the major constituents and it rained true for all the major stocks in the index that day. Wouldn't surprise me if we did re-test that 4370-4390 level (on the XJO) at some point and then had the buyers come back in?

Gotta dance until the music stops I guess so keep buying those dips??!!!