nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

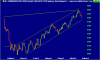

Where does everything think the All Ords will go over the coming days/weeks?

Drop below 4500 or power on upwards?

The xao appears to have dropped from the upper channel bar to the lower channel bar in only 5 working days, what happened in Australia that warranted this?

Sellers being more aggressive than buyers!Love the volatility!

xjo printing weekly outside down bar despite very high money flows inwards and on the back of break fo crucial support levels on spx and frothy top on hsi

....weak bargains looking to get culled over next few sessions....good time for health check of non performers......

Sounds ominous

Is there anywhere you can se the futures for tomorrows trading ?

I had a link to the US one somewhere but don't recall ever seeing one for the ASX.

From my 5 seconds of investigation, Commsec has live SPI prices on the banner that scrolls across the front of their homepage.

Otherwise SFE has 20 minute delayed SPI prices. There's plenty of other third party websites that give delayed SPI prices too.

Thanks i was thinking more of trades/orders placed after hours that give an indication of what the next day might be like........

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.