- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

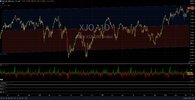

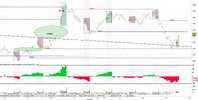

The Oanda AU200AUD CFD tracks SPI futures so 7521 shown here as a 50% retracement of the recent upmove is not the same as 7521 on the cash XJO, I actually think it's very very close to XJO 7500

View attachment 169968

and there it is