You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

XAO Banter Thread

- Thread starter clayton4115

- Start date

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

Agreed. However I just find it hard to believe the rate would go down by just 0.1% in March but as you say, the expectations are crappy at best and unpredictable at worst.

This one is for @PZ99

https://www.abc.net.au/news/2020-04...loyment-rate-barely-rose-coronavirus/12154954

PZ99

( ͡° ͜ʖ ͡°)

- Joined

- 13 May 2015

- Posts

- 3,320

- Reactions

- 2,428

Thanks, saw that earlier: first two weeks of March.

Curiously, the Citi economist says the unemployment rate might peak at 8.4%

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

Thanks, saw that earlier: first two weeks of March.

Curiously, the Citi economist says the unemployment rate might peak at 8.4%

I get the feeling that the 8.4% ballpark is what the market is currently pricing in, I think any signs it will be going higher than that could elicit quite a painful reaction.

PZ99

( ͡° ͜ʖ ͡°)

- Joined

- 13 May 2015

- Posts

- 3,320

- Reactions

- 2,428

So I guess the Govt might set a date for unwinding restrictions somewhere near the next report to offset such a reaction?

Logique

Investor

- Joined

- 18 April 2007

- Posts

- 4,290

- Reactions

- 768

There's a squeeze on, no doubt. If you go searching for it, there's any amount of opinion for a V-shaped recovery, as occurred post SARS in 2003.

So just what is the "smart money" up to? They're doing a good job of keeping ordinary punters on the sideline. But somebody is buying, the market indices show it, the XAO up 2.5% this morning.

i) https://www.cnbc.com/2020/03/13/bar...et-is-going-to-come-ripping-back-quickly.html

The stock market is going to come ripping back quickly, says global investor Barry Sternlicht

MAR 13 2020 ..He added that he sees a “V-shaped” bounce for the market, meaning a quick down and a quick back up..

ii) https://www.japantimes.co.jp/news/2...overy-virus-hit-chinese-economy/#.XpkGB8hMTro

IMF chief expects China to bounce back with quick, V-shaped recovery

..IMF Managing Director Kristalina Georgieva said in a statement that the “most likely scenario we now view is a V-shaped impact,” as factories in China gear up to make up for lost time and warehouses are re-supplied..

So just what is the "smart money" up to? They're doing a good job of keeping ordinary punters on the sideline. But somebody is buying, the market indices show it, the XAO up 2.5% this morning.

i) https://www.cnbc.com/2020/03/13/bar...et-is-going-to-come-ripping-back-quickly.html

The stock market is going to come ripping back quickly, says global investor Barry Sternlicht

MAR 13 2020 ..He added that he sees a “V-shaped” bounce for the market, meaning a quick down and a quick back up..

ii) https://www.japantimes.co.jp/news/2...overy-virus-hit-chinese-economy/#.XpkGB8hMTro

IMF chief expects China to bounce back with quick, V-shaped recovery

..IMF Managing Director Kristalina Georgieva said in a statement that the “most likely scenario we now view is a V-shaped impact,” as factories in China gear up to make up for lost time and warehouses are re-supplied..

Last edited:

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

Logique

Investor

- Joined

- 18 April 2007

- Posts

- 4,290

- Reactions

- 768

Apropos of which, as you mention IB:

https://www.statnews.com/2020/04/16...uggests-patients-are-responding-to-treatment/

Early peek at data on Gilead coronavirus drug [Remdesivir] suggests patients are responding to treatment APRIL 16, 2020 - By ADAM FEUERSTEIN @adamfeuerstein and MATTHEW HERPER @matthewherper

Remdesivir is a nucleotide (adenosine) analogue, which inserts into viral RNA chains

https://www.statnews.com/2020/04/16...uggests-patients-are-responding-to-treatment/

Early peek at data on Gilead coronavirus drug [Remdesivir] suggests patients are responding to treatment APRIL 16, 2020 - By ADAM FEUERSTEIN @adamfeuerstein and MATTHEW HERPER @matthewherper

Remdesivir is a nucleotide (adenosine) analogue, which inserts into viral RNA chains

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

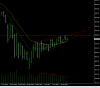

ok, ok, I know this chart is starting to develop a lot of lines but nonetheless. Extending the line from the breakdown pattern I posted in post #3248, looks like it was still in play. I made it thick/red to stand out from the other lines.

Additionally, the post 4PM close has ended as a rejection of the trend line, again.

We continue the pattern of going up on the wrong side of the trend lines.

Additionally, the post 4PM close has ended as a rejection of the trend line, again.

We continue the pattern of going up on the wrong side of the trend lines.

- Joined

- 2 August 2016

- Posts

- 897

- Reactions

- 1,491

The latter, for a start.Was just drawing random lines on the hourly chart and noticed this

View attachment 102361

breakout? or retrace to bottom?

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

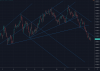

Forgot to do the weekly check-in on the weekends, do a quickie now before the market opens:

Monthly chart not a lot to report, aside from per last weekend update, the last completed monthly ATR was 494 points, the range for this month is now exceeding that at 550 points.

Weekly, last week was another up week, but on much lower range. We still closed the week above the December 2018 lows. Bulls couldn't muster the strength to test the weekly close from the 2nd week of March and as you can see we ended not far from where we started.

Daily, still making higher highs on five bar swing pattern, no higher low last week. That downward continuation pattern seems to becoming more pronounced and less like a bullish consolidation.

4 hourly, as you can see no meaningful move in intraday action for last week, just chopping around the 0.382.

Monthly chart not a lot to report, aside from per last weekend update, the last completed monthly ATR was 494 points, the range for this month is now exceeding that at 550 points.

Weekly, last week was another up week, but on much lower range. We still closed the week above the December 2018 lows. Bulls couldn't muster the strength to test the weekly close from the 2nd week of March and as you can see we ended not far from where we started.

Daily, still making higher highs on five bar swing pattern, no higher low last week. That downward continuation pattern seems to becoming more pronounced and less like a bullish consolidation.

4 hourly, as you can see no meaningful move in intraday action for last week, just chopping around the 0.382.

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

A couple of different hourly chart views

The channel from post #3269

The channel from post #3269

Was just drawing random lines on the hourly chart and noticed this

View attachment 102361

breakout? or retrace to bottom?

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

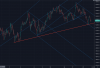

Well, I had been watching this trendline that I posted last night since early April, wondering if it was a silly line that was too wide off two swing lows that were too close together.

Updated hourly with that line re-formatted to highlight in red/thick:

was pretty much exactly where the market bounced in the overnight session.

Looks like the market is still deciding whether April will be an up month, going to be an interesting session today.

Updated hourly with that line re-formatted to highlight in red/thick:

was pretty much exactly where the market bounced in the overnight session.

Looks like the market is still deciding whether April will be an up month, going to be an interesting session today.

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

- Joined

- 10 June 2007

- Posts

- 4,045

- Reactions

- 1,404

beautiful rotation in the front month cfd for Sp200 (XJO)

a few false positives in the indicators ...yaget that !

a few false positives in the indicators ...yaget that !

- Joined

- 10 June 2007

- Posts

- 4,045

- Reactions

- 1,404

in the play book of "how to spot intent"

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

Similar threads

- Replies

- 75

- Views

- 10K

- Replies

- 85

- Views

- 27K