- Joined

- 13 December 2015

- Posts

- 492

- Reactions

- 152

what leads whatWe'll it indicated a volatility crush which was followed by massive short covering rally....

what leads whatWe'll it indicated a volatility crush which was followed by massive short covering rally....

What defines "single session reversal"?

Surely there have been bigger moves...like this one less than six months ago...

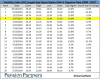

View attachment 70541

After the biggest gap down open in a long time a squeeze wasnt exactly a low probability event and with all due respect i still fail to see an edge in VIX at all . Are you suggesting VIX was a leading indicator here and if so how , I am interested .We'll it indicated a volatility crush which was followed by massive short covering rally....

This is just common sense Smurf and I share your thoughts.Obviously, the can could still be pushed a couiple of years: more negative interest, debt debt debt debt, and it can not end well;the trouble is that it is hard to resist but you have to think it that way: is the risk worthwhile for a 5% or so gain a year for maybe what 2-3 y at most and then lose most of your saving/assets with a 60/70% fall which would be match by economic/RE crisis?I believe we are too far ahead and got out from the stockmarket in the last month, from what was conservative to a hurricane shelter position;Have I lost the plot here and become way too bearish? Or are others having similar concerns?

This. In the near term, I think we move up next. Still looks a a momentum play to me.Triangle breakout target 6025.

View attachment 70551

Looks like a market ready for a reset to me!

I'm hoping Trump succeeds over the next 18 months with his fiscal policies as I want interest / bond yields run up as high as possible before the various asset bubbles keel over. Stocks would continue their gains but would ultimately be built upon the greater fool theory.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.