- Joined

- 29 August 2014

- Posts

- 500

- Reactions

- 72

Going nowhere

I'm with you ... Sold a lot the last few days.... Thinking of selling the rest.View attachment 69587

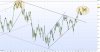

Banks toppy , just got the lighten memo from my bank man , i say tops in for a month , sell the pops is my MO from here , nice bearish reversal at channel extreme , just where i like em View attachment 69585

Surely something's got to give before too much longer? Either we're going up or we're going down, right? Anyone have thoughts as to which way?

Surely something's got to give before too much longer? Either we're going up or we're going down, right? Anyone have thoughts as to which way?

My own thought is that down is more likely than up and that the drop in commodities producers and some commodities themselves is plausibly a warning. I could be wrong of course....

US jobless claims - now there's a measure I hadn't thought of looking at.The trajectory of U.S jobless claims is still positive and should continue for the next 12 months with government policy on tax, jobs and infrastructure. A severe downturn usually only happens 6+ months after U.S jobless claims hit a bottom

Well almost a month gone and I'm Out of One of the banks completely Just a median parcel left of another.I'm with you ... Sold a lot the last few days.... Thinking of selling the rest.

While I am enjoying the recent run I don't quite understand it.

Well almost a month gone and I'm Out of One of the banks completely Just a median parcel left of another.

Waiting for a down turn I guess.

Cant say i'm a huge fan of VIX for anything . A derivative of a derivative of a derivative , too far from reality for me tbhThe vix put in what appears to be the biggest single session reversal in its history last night....

Cant say i'm a huge fan of VIX for anything . A derivative of a derivative of a derivative , too far from reality for me tbh

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.