michael_selway

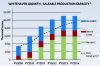

Coal & Phosphate, thats it!

- Joined

- 20 October 2005

- Posts

- 2,397

- Reactions

- 2

Hm does anyone still own this one?

thx

MS

Earnings and Dividends Forecast (cents per share)

2007 2008 2009 2010

EPS 8.0 31.3 22.4 40.6

DPS 0.0 6.5 8.8 17.9

thx

MS

Earnings and Dividends Forecast (cents per share)

2007 2008 2009 2010

EPS 8.0 31.3 22.4 40.6

DPS 0.0 6.5 8.8 17.9