Ive got the first one sorted.

If someone can help me with the second one one I would really appreciate it.

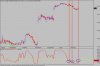

I need it to give just one buy signal not 2.

http://i409.photobucket.com/albums/p...0SMA/20SMA.png

Range1=Optimize("range1",20,20,50,1);

Buy = Close > Ref( MA( Close , Range1 ) , -2 )

AND MA( Close , 20 ) > Ref( MA( Close , 20 ) , -1 ) ;

Sell = MA( Close , 20 ) < Ref( MA( Close , 20 ) , -2 ) ;

Buy = ExRem(Buy,Sell);

Sell = ExRem(Sell,Buy);

If someone can help me with the second one one I would really appreciate it.

I need it to give just one buy signal not 2.

http://i409.photobucket.com/albums/p...0SMA/20SMA.png

Range1=Optimize("range1",20,20,50,1);

Buy = Close > Ref( MA( Close , Range1 ) , -2 )

AND MA( Close , 20 ) > Ref( MA( Close , 20 ) , -1 ) ;

Sell = MA( Close , 20 ) < Ref( MA( Close , 20 ) , -2 ) ;

Buy = ExRem(Buy,Sell);

Sell = ExRem(Sell,Buy);