- Joined

- 28 March 2006

- Posts

- 3,561

- Reactions

- 1,290

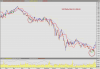

Hi, Could you post the pre March 2009 chart. March 2008 to March 2009. Thanks.

No problem, have also included the XJO for the same period to maintain an overall view of where the market is at to eliminate any "an indicator is better than the market" false enthusiasm events.

(click to expand)