- Joined

- 21 June 2009

- Posts

- 5,880

- Reactions

- 14

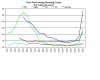

The-Elusive-Canadian-Housing-Bubble-Summer-2010

an interesting article on the canadian bubble, which may have peaked, and the australian bubble appears to be perpetually growing

as much as i would absolutely love to own a property, i still have a huge reluctance to add to the bubble and bid on a property at levels 7.5+ income

i am inclined to think that despite the ability for australians to borrow vast sums of debt and be completely comfortable in inflating the bubble further, i have to abstain from that insanity..

cant say i am happily waiting for the inevitable collapse, as many friends and family have invested heavily in supporting the current bubble, and i think it will hurt big time when it finally peaks and falls.. which may be sudden or may well be decades long,, but blindly spending the largest sum of capital that most people loan on a property that in all likelihood will depreciate is not my idea of a wise move

ts or robots, am i seeing it all wrong? or can you explain what factors or arguments can be presented in convincing bears like me to invest in property right now?

Sorry Agentm .... we have given you many reasons, theories, motion of discoveries, charts, pie graphs, matrix's, and many more researched data over the last 137 pages. Even gave links to web pages where people far more cleverer than me and the Botman have elucidated the knowledge you seek.

But let me leave you with this gem - AVERAGE house price values have fallen for the first time in 17 months as interest rate hikes begin to bite. 0.7% ABS has quantified this FACT. a whopping 0.07%. Nevermind they have risen over 20% nationally.

ABS AND RBA figures also state that it is not 7.5 times wages either. I think it is about 5 times.