tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,447

- Reactions

- 6,477

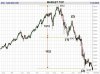

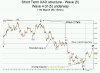

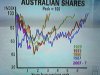

tech, a query - the last leg from wave 4 to the low looks very much like a 3 wave move - do you have a chart with the details of this last leg?

Cheers OWG

Not here but at home.

Will post it tonight.