- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

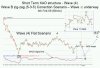

I can't think of a pattern to explain sensibly the market action from the 23rd January to the current date.

Rudy, don't get too hung up on it. it didn't look like a 5 wave move up, so a complex correction appears valid, and there's a triangle which is a key signal. I'll post something later on how I believe it should be labeled.

Try to keep projected roadmaps as simple as possible - an expanded triangle for wave b - well maybe, but the odds simply don't favor it. How many expanded triangles have you seen lately?

Use the KISS principle + 5 wave identification