- Joined

- 12 May 2008

- Posts

- 499

- Reactions

- 7

Re: Strategy for trading the ASX200 daily

dont actually trade BHP, so dont know what its doing.

but APF rules say:

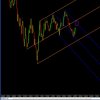

consider short at pink circle (which i think is around todays prices),

at which time price may find resistance and retreat to lower orange line

good luck!

dunno about your pitchforks but ive entered a BHP short as of today

happy to drop it like a hot spud if wrong also

dont actually trade BHP, so dont know what its doing.

but APF rules say:

consider short at pink circle (which i think is around todays prices),

at which time price may find resistance and retreat to lower orange line

good luck!

= At the bottom of the markets we see whipsawing and bottom bouncing so a trailing stop and/or profit target would be a healthy choice.This could be part of your trading plan before opening a trade and if it helps ... write it down and follow it to the letter.

= At the bottom of the markets we see whipsawing and bottom bouncing so a trailing stop and/or profit target would be a healthy choice.This could be part of your trading plan before opening a trade and if it helps ... write it down and follow it to the letter.