- Joined

- 22 June 2006

- Posts

- 198

- Reactions

- 0

hi all

can anyone provide some insight into your trading strategy in trading the asx200 index,

i'm currently using CFDs and with the current rally on the market ive basically lost most of my profits i built up over the last couple of months,

im going short the asx200 and would like to know what strategy you employ in trading the asx200,

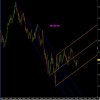

i use the 30 min chart to reduce noise and misleading indicator signals but i have had very limited success,

what techniques do you use?

can anyone provide some insight into your trading strategy in trading the asx200 index,

i'm currently using CFDs and with the current rally on the market ive basically lost most of my profits i built up over the last couple of months,

im going short the asx200 and would like to know what strategy you employ in trading the asx200,

i use the 30 min chart to reduce noise and misleading indicator signals but i have had very limited success,

what techniques do you use?