- Joined

- 3 May 2019

- Posts

- 6,340

- Reactions

- 10,018

Thank you Skate, nice of you to post the chart of RFT with your technical indicators.Rectifier Technologies Limited (RFT) - supporting chart

@aus_trader another great find. Your summation adds validity in supporting your ultimate purchase - well done.

View attachment 114707

Skate.

I buy a few speculative stocks every now and then with money I can afford to lose, so smallest parcels of around $500 each per stock. '...with money I can afford to lose' is very misleading as it sound like I have excess that I don't know what to do with ! Quite the opposite is true, I am an average Aussie battler and the money I put into these stocks is any free cash that I have after priorities are taken care of. Priorities are having sufficient funds for: mortgage, utility bills, car expenses, entire amount for monthly credit card balance (not the minimum repayment!), and living expenses (food/clothes etc). Once the basic priorities are taken care of, I have a few thousand in a cash account for emergencies or for a holiday. Then I have money put into longer term stocks with some funds usually kept for new stock positions with a longer term horizon. With any remaining cash, I will buy speculative stocks mentioned in this thread. These include mining hopefuls, new technology startups and turnaround stories of companies trying to recover from near collapse. I have not been including these in my "Medium/Longer Term Stock Portfolio" as these tiny speculative stocks have wild swings such as 50% up or down days and once in a while one of these can go into administration and I will lose the entire stake in that stock, that's a 100% loss on that investment. So I didn't want that level of volatility in a longer term portfolio, hence the birth of this new thread "Speculative Stock Portfolio".

Although it's not common, I have had a few of them that went into bankruptcy either due to poor decision making (such as paying a huge amount for almost a worthless asset), racking up massive debts or running out of money and not being able to raise more capital. In these instances I have lost the amount put into that stock, usually around $500.

Two full paragraphs about Risks buying speculative stocks and depressive text about losing the entire investment in a stock. Usually speculative stock threads start with the biggest hype and excitement with predictions of the next tiny-cap stock that's shooting to the stars from what I've seen in forums. But with decade long experience and having survived through the GFC, I want to be realistic with the risk I'm taking with each speculative purchase.

So why put any money into these penny stocks anyway? Well, given the risk I'm taking, the story has to be big with each pick with potential to return multiple times the initial stake.

So the first stock for this portfolio is a new technology stock involved in using technology to cleanup environmental problems. These problems include air pollution, mining and chemical issues. Company is "Clean TeQ Holdings Limited (CLQ)" bought on 7th of July for 70.5c, a quantity of 750 shares.

I note the Speculative Portfolio nature of this thread.much, much, MUCH

Yes you have the same line of thinking as me Mr. frugal rockstar !I note the Speculative Portfolio nature of this thread.

APT is very speculative as it's way overpriced, the smart money has mostly already started rotating out of it, as expected for any stock losing momentum and thrust... it's complicated rocket science

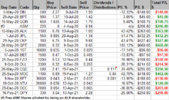

Underperforming stocks have been given a lot of time to align with the recovery of stocks, but running out of patience so they've been chopped... NTU, DCC and OPY.

Closed:

View attachment 122781

Rare Earth stock NTU went for a good run but has continued to pull back, testing my patience so eventually decided to sell it. I like to acknowledge when other ASF members have outperformed and @barney has alerted us to another Rare Earth stock VML (see VML thread) which has gone for a really good run. I nearly put VML in this portfolio, but at the time it was too volatile for me to decide on a stop loss if I bought it.

That decision to sell BET really hurt. ouch. BIN not far behind. A couple of potential kingmakers right there.

I believe the outcomes on your list would be a lot different in a normal market. As we know the ASX is predominantly made up of complete rubbish so I suspect there would a lot more red on that list during normal operations.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.