Dona Ferentes

Pengurus pengatur

- Joined

- 11 January 2016

- Posts

- 16,523

- Reactions

- 22,537

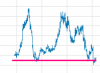

After selling most of my SLC after a poor result, last month, I went back in today at $1.08. This follows the First State superfund takeover move on OptiComm OPC. If some long term player is gobbling up fibre optic networks, then there's a possibility another one could fall. Especially as a prior offer was at $1.90, even though it was pulled.