- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

OK, had a very busy weekend, but here is my reasoning for buying Mortgage Choice Limited (MOC). I've been watching it for a while and didn't pull the trigger till Friday because sometimes buying too early is just as costly as buying too late. I have had quite a few stocks that has gone initially against me and once I have exited, it has soared like there is no tomorrow.  So perhaps my initial analysis was good but the timing was awful, and because this is a trading portfolio it's not like I can hope and pray when a position has gone a fair bit against me.

So perhaps my initial analysis was good but the timing was awful, and because this is a trading portfolio it's not like I can hope and pray when a position has gone a fair bit against me.

Anyway, I think MOC is at an inflection point where it may be the right time to buy. It's also got multiple triggers that's got me exited, such as:

I don't think there is many competitors to MOC on ASX either, so MOC is kind of a monopoly to dominate across the ASX. I could find Aussie Home Loans as a competitor, but they are not listed on the ASX.

On a long term charting perspective, MOC has bounced back from what looks like a false break of the All-Time-Lows:

On a medium term chart, it's made a breakout to the upside, which is encouraging:

I also bought a smaller stake in another stock in an area that I was researching up. I was encouraged by the take over of 3P Learning Ltd (3PL), that was offered a very nice premium to it's share price, so started searching everywhere for similar themes throughout the asx.

Although not exactly in the same online learning space for kids, I found another stock that is in the area of online security for kids. It has run up quite a bit lately and I am not a big fan of chasing stocks. Yes, I realise that might be counter-intuitive to a lot of the momentum traders and other system based trading members on the forum. So anyway I decided to try my luck with a smaller position size than I would normally buy during the closing minutes of Friday's session. The company is Family Zone Cyber Safety Ltd (FZO).

They basically protect children across all devices for schools, home etc:

Although not profitable yet, this company has been growing fast. In fact the pandemic has anything but accelerated that growth it seems:

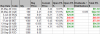

Open Portfolio:

So perhaps my initial analysis was good but the timing was awful, and because this is a trading portfolio it's not like I can hope and pray when a position has gone a fair bit against me.

So perhaps my initial analysis was good but the timing was awful, and because this is a trading portfolio it's not like I can hope and pray when a position has gone a fair bit against me.Anyway, I think MOC is at an inflection point where it may be the right time to buy. It's also got multiple triggers that's got me exited, such as:

- Good fundamental reasons and why favourable conditions are just about set for this stock

- On a longer term chart, MOC has hit All-Time-Lows and bounced back

- On a shorter/medium term chart MOC is breaking out to the upside

I don't think there is many competitors to MOC on ASX either, so MOC is kind of a monopoly to dominate across the ASX. I could find Aussie Home Loans as a competitor, but they are not listed on the ASX.

On a long term charting perspective, MOC has bounced back from what looks like a false break of the All-Time-Lows:

On a medium term chart, it's made a breakout to the upside, which is encouraging:

I also bought a smaller stake in another stock in an area that I was researching up. I was encouraged by the take over of 3P Learning Ltd (3PL), that was offered a very nice premium to it's share price, so started searching everywhere for similar themes throughout the asx.

Although not exactly in the same online learning space for kids, I found another stock that is in the area of online security for kids. It has run up quite a bit lately and I am not a big fan of chasing stocks. Yes, I realise that might be counter-intuitive to a lot of the momentum traders and other system based trading members on the forum. So anyway I decided to try my luck with a smaller position size than I would normally buy during the closing minutes of Friday's session. The company is Family Zone Cyber Safety Ltd (FZO).

They basically protect children across all devices for schools, home etc:

Although not profitable yet, this company has been growing fast. In fact the pandemic has anything but accelerated that growth it seems:

Open Portfolio: