over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,288

- Reactions

- 7,493

USA is screaming so AU will naturally follow. Triple levered etf's and just ride it

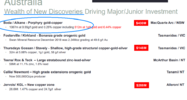

Fwiw, has been selected by my systems and i oweI've been keeping my eye on a turnaround mining play and it's no secret that I have made some recent posts about it including in the Potential Breakout Alerts! thread as well as stock specific MLX thread.

Research was done on MLX and looks like the worst is behind this mining stock which is probably the best asx listed Tin miner. However due to a Copper mining venture that became a headache for the company it's profitability and hence the share price has been hammered. I wrote a little background on the company in the breakout thread as per below:

""

Historically has done well with Tin. It's been a consistent dividend player in the past when it was a pure Tin play which I enjoyed in some yesteryear long ago.

Then they got greedy or didn't know what to do with all that profits pouring out of their Tin mine, so they ventured into a terrible Copper investment and had been heavily wounded, not to mention completely stopping the dividends as a result.

I think MLX is looking better since finally making the decision to get rid of the Nifty copper mine, to stop the heavy blood shed. What a name Nifty, yeah right ?

Could be a good turn-around mining play...time will tell. If all goes well, who knows if they even bring the dividends back one day

""

MLX has done a few things right lately and looks like the share price is heading in the right direction. They sold their Copper operations for a total of $60m which is not bad and they've cut their debt in half. Also reducing staff as they don't need people standing around for a Copper mine that was on care and maintenance.

Although price has pulled back a bit by the day's close, it looked like price was likely to breakout higher during the day. So I bought a few shares for this portfolio. Fundamentals point to a turnaround mining play and technical picture is half decent because I can't time a perfect breakout to buy into...

View attachment 123718

Open Portfolio:

View attachment 123719

Got rammed by the brutal CGC sell down today with the huge gap down !

Beats me @barney, hence the frustration.Damn @aus_trader

I hate seeing those drops on any chart. Had a couple of of very expensive ones myself over the years.

CGC seemed to have a reasonable year 2020 by the reports. What was the reason they got smashed so hard do you think?

CGC seemed to have a reasonable year 2020 by the reports.

Overstaying your welcome

Staying too long in a trade is a recipe for disaster.

Anyway this is a trading portfolio, so I have to cut and move on sadly.

Doubt it will comfort you but these last few weeks saw a couple of these falls hitting me seriously:Making money when trading

In my experience, the timing of the exit is where the money is made. Cutting losing trades early is the secret of being a profitable trader. When a trade goes against you - how you handle the position will eventually decide how successful you will be as a trader. IMHO - the timing of your exit has to be the most important part of your trading strategy.

The importance of an exit

It’s important to remember the "EXIT" really "determines the final outcome" of a trade leading to the long-term success or failure of any trading strategy.

**** happens

@aus_trader no one knowingly puts themselves in harm's way but no matter how smart we are, or how hard we work, we will regularly be hit by developments that are unforeseen. Follow your own advice & move on to the next trade. Losing is part of the trading process, so take it on the chin & be the ‘best loser’ you can possibly be.

Where I would have exited

The chart below displays the entry & exit position for comparison purposes only. The "Ducati Blue Bar Strategy" is uncannily accurate with the turning points of a trend.

View attachment 125083

Exits really matter

I hope the chart helps you better understand the importance of a well-crafted exit strategy.

Skate.

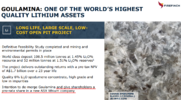

You've gone to further detail as to why I mentioned this is a higher risk Gold play due to the jurisdictions where the deposit and mining operations reside. But in a portfolio of stocks such as this, I am willing to put some capital into it as it has potential to outperform other holdings based on my research. Definitely not one to bet the farm on, as it's a high risk / high reward speculation !Firefinch Ltd (FFX)

Great company with a very good mine and bonus lithium deposit. Current market cap is only $300mil.

“We have a projected production profile of 50-60,000oz this year, 120,000oz next year, 170,000oz in 2023, and 200,000oz in 2024,” says Anderson (Managing Director).

The risk and the likely reason for the big price discount (despite the bonus steak knives) is the political situation which escalated again on 24 May.

In BriefThree members of Mali's civilian transitional leadership, including the president and prime minister, were arrested by the army following a government reshuffle in late May, only seven months after an 18-month transitional government was formed, following a coup in August 2020. Short-term political uncertainty will prevail, the military will maintain a central role in the political landscape, and the security situation will remain dire.

Mali plunged back into crisis on Monday (24 May) when military officers detained the interim president, prime minister and defence minister, derailing a transition back to civilian rule after last year's coup.The latest events threaten to exacerbate instability in the West African country where violent Islamist groups linked to al Qaeda and Islamic State control large areas of the north and centre. Following are details on the origins of the crisis and the risks it poses to the region.WHAT HAPPENED?President Bah Ndaw, Prime Minister Moctar Ouane and Defence Minister Souleymane Doucoure were taken to a military base outside the capital Bamako, hours after two members of the military lost their positions in a government reshuffle.Ndaw, a retired colonel, was sworn in as interim president in September after President Ibrahim Boubacar Keita was overthrown by the military the previous month. He was tasked with leading an 18-month transition to new elections.He has faced a difficult balancing act, with various political factions and the leaders of the coup against Keita all jockeying for political influence.WHY DID THE MILITARY DO IT?The military's ultimate goal was not immediately clear, but its actions came after two of the leaders of last year's coup, Sadio Camara and Modibo Kone, lost their posts as defence and security minister in a government reshuffle.A senior former Malian government official told Reuters that the sacking of Camara and Kone was "an enormous misjudgment" and that the military's actions were probably aimed at restoring them to their posts.WHY ARE MALI'S NEIGHBOURS AND ALLIES WORRIED?Mali's international partners are concerned about the implications for regional security. Groups linked to al Qaeda and Islamic State are based in Mali and have taken advantage of previous bouts of political instability.After a coup in 2012 ousted then-President Amadou Toumani Toure, al Qaeda-linked insurgents exploited a power vacuum to seize Mali’s desert north.Since then, international powers, led by France, have deployed thousands of troops and spent billions of dollars to try to stabilise the country. But they have had little success as the Islamists continue to carry out regular attacks on the army and civilians. They also use Mali as a launch pad for attacks in neighbouring countries like Niger and Burkina Faso.European leaders worry that prolonged regional instability could see more people displaced, fuelling another wave of migration to their shores.

Factbox: Why Mali is in turmoil again

Mali plunged back into crisis on Monday when military officers detained the interim president, prime minister and defence minister, derailing a transition back to civilian rule after last year's coup.www.reuters.com

If the political situation can be stabilised the share price will very quickly be multiples of the current price. If the deposits were in Aus, the market cap would be 5 times the current $300mil. Definitely a high risk, high reward play.

aus_trader I dont want to hijack your thread, if you would rather this posted in the FFX thread I can ask Joe to move it

Guys, just be aware mali burkina faso are similar to Afghanistan with the taliban wonning, france army is currently disengaging and leaving the place.no new mine there in the coming decades or even exploration possible..my opinionFirefinch Ltd (FFX)

Great company with a very good mine and bonus lithium deposit. Current market cap is only $300mil.

“We have a projected production profile of 50-60,000oz this year, 120,000oz next year, 170,000oz in 2023, and 200,000oz in 2024,” says Anderson (Managing Director).

The risk and the likely reason for the big price discount (despite the bonus steak knives) is the political situation which escalated again on 24 May.

In BriefThree members of Mali's civilian transitional leadership, including the president and prime minister, were arrested by the army following a government reshuffle in late May, only seven months after an 18-month transitional government was formed, following a coup in August 2020. Short-term political uncertainty will prevail, the military will maintain a central role in the political landscape, and the security situation will remain dire.

Mali plunged back into crisis on Monday (24 May) when military officers detained the interim president, prime minister and defence minister, derailing a transition back to civilian rule after last year's coup.The latest events threaten to exacerbate instability in the West African country where violent Islamist groups linked to al Qaeda and Islamic State control large areas of the north and centre. Following are details on the origins of the crisis and the risks it poses to the region.WHAT HAPPENED?President Bah Ndaw, Prime Minister Moctar Ouane and Defence Minister Souleymane Doucoure were taken to a military base outside the capital Bamako, hours after two members of the military lost their positions in a government reshuffle.Ndaw, a retired colonel, was sworn in as interim president in September after President Ibrahim Boubacar Keita was overthrown by the military the previous month. He was tasked with leading an 18-month transition to new elections.He has faced a difficult balancing act, with various political factions and the leaders of the coup against Keita all jockeying for political influence.WHY DID THE MILITARY DO IT?The military's ultimate goal was not immediately clear, but its actions came after two of the leaders of last year's coup, Sadio Camara and Modibo Kone, lost their posts as defence and security minister in a government reshuffle.A senior former Malian government official told Reuters that the sacking of Camara and Kone was "an enormous misjudgment" and that the military's actions were probably aimed at restoring them to their posts.WHY ARE MALI'S NEIGHBOURS AND ALLIES WORRIED?Mali's international partners are concerned about the implications for regional security. Groups linked to al Qaeda and Islamic State are based in Mali and have taken advantage of previous bouts of political instability.After a coup in 2012 ousted then-President Amadou Toumani Toure, al Qaeda-linked insurgents exploited a power vacuum to seize Mali’s desert north.Since then, international powers, led by France, have deployed thousands of troops and spent billions of dollars to try to stabilise the country. But they have had little success as the Islamists continue to carry out regular attacks on the army and civilians. They also use Mali as a launch pad for attacks in neighbouring countries like Niger and Burkina Faso.European leaders worry that prolonged regional instability could see more people displaced, fuelling another wave of migration to their shores.

Factbox: Why Mali is in turmoil again

Mali plunged back into crisis on Monday when military officers detained the interim president, prime minister and defence minister, derailing a transition back to civilian rule after last year's coup.www.reuters.com

If the political situation can be stabilised the share price will very quickly be multiples of the current price. If the deposits were in Aus, the market cap would be 5 times the current $300mil. Definitely a high risk, high reward play.

aus_trader I dont want to hijack your thread, if you would rather this posted in the FFX thread I can ask Joe to move it

From what I read the company is pretty engaged with the local Govt and provide jobs and funding for locals. I think that can make a difference in terms of being able to stay on and continue operations...Guys, just be aware mali burkina faso are similar to Afghanistan with the taliban wonning, france army is currently disengaging and leaving the place.no new mine there in the coming decades or even exploration possible..my opinion

I still believe the above is very much an Australian thinking in place:From what I read the company is pretty engaged with the local Govt and provide jobs and funding for locals. I think that can make a difference in terms of being able to stay on and continue operations...

View attachment 125848

It's not just in Africa, it can happen in our front yard as well, in Papua (PNG) to be more precise. I know big mines such as Lihir owned by Australia's biggest Gold miner Newcrest is still pushing along but some of the smaller exploration companies have been screwed over when trying to do business there. Once millions have been spent and a nice resource with robust economics have been defined, ready to mine the local Govt and landowners will confiscate the entire asset and simply tell the Aussies to FUK off.

How cool is that ? There's no arguments, there's no law to deal with (local Govt is the law), there's no compensation for tens or hundreds of millions spent to explore and define a huge deposit, just suck it up and go emptyhanded and declare bankruptcy on the asx so the shareholders get nothing for their hard earnt. I don't know the finer details of where such deals go wrong but if you are not working with the locals and adding value to the community, I think they can show who's the boss. It's happened to multiple explorers in multiple countries over the years, PNG was just one example that is closest to us Aussies.

Yeah, looks more riskier than my initial assessment in terms of the location of the asset, not the asset itself which would be really undervalued if it happened to exist in Australia.I still believe the above is very much an Australian thinking in place:

I genuinely wish you well:

please search about:

Mali and the local IS jihadist branch

And Burkina Faso:

all this in the last weeks:

At least 138 killed in 'horrific' massacre on civilians in Burkina Faso's north

The death toll from the worst militant attack in Burkina Faso in recent years has risen to 138, the government said after armed assailants laid siege overnight to a village in the jihadist-plagued north-east.www.sbs.com.au

West Africa's Islamist insurgency: Fight at a critical stage

The multinational effort to stave off an encroaching takeover by Islamist militants faces severe challenges.www.bbc.com

Mali is the base for the IS jihadists, and they do not want schools, trees or wells ...just infidels blood...

I am well aware of the local situation as I declined to be sent there for a contracting role in a (different) international Gold miner

a couple of years ago; less than a week later , one of their armed convoys was attacked and annihilated

massacres are weekly, this is NOT PNG

PNG or Salomon islands/Timor are kid's play compared ...

The key here is that:

France is pulling out officially or not (Operation Barkhane) after far too many losses for no gain

and very strong opposition from France's population as we have enough of these very same fighters on the mainland without fighting them in the sands of Africa

So all that northern part is going to fall to IS

So please DYOR, look at maps and BBC, al jazera, etc

Anyway, when people are rising auctions on thin air or jpeg images, you might be on a winner.

But this is lottery, not investing after if it rises or falls, we will find logical explanation

Can I short it? ;-)

I will stop there.Let's rejoin the thread

Good...Took profits on half of the FFX position as the price gapped up due to a funding announcement today. Will update portfolio later...

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.