- Joined

- 13 February 2006

- Posts

- 5,001

- Reactions

- 11,241

Friday is the big one with U/E.

Mr fff:

It Ended OK! Up We Go

Dr. Fly Fri Aug 30, 2024 4:09pm EST Leave a commentLet’s just say I am happy with the close, so happy I will drink some gin to celebrate. So you know, I do not ever drink whilst angry or walking the black dog. I drink to celebrate and only associate that feeling with success.

I closed the session +85bps and possess 10% cash into Tuesday. Markets are closed on Monday to celebrate “Labor Day.”

On Sunday I depart for Boston to move my daughter into her apartment for her final year of college. It is a bitter sweet occasion, sweet only because I am proud of her and want to see her succeed and chase her dreams.

I closed the month +2.84%, better than all indices, but way below my own quant of +6.2% It was a unique month for the quant, as it was perfectly positioned in financials and stocks that really held their own the entire month.

At any rate, a new quant will be allocated into Stocklabs on Tuesday, as I always do, and I look forward to dealing with the pangs, and also the horrors, of what September is for traders.

Quick note on my prospective return to the business: I have your emails and will schedule you for a call when time permits. I have been overwhelmed by the response and will likely only accept 150 clients. If you were fence sitting about having Le Fly manage your vast sums of money, I suggest you quit doing that, post haste. Contact flybroker @ gmail for inquiries.

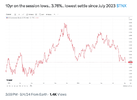

Any number of blogoland's contributors are pointing out that September (late) and October are bad months for the market. We also have the long awaited rate cuts (supposedly) happening in the Sept. meeting. The data on that has also been studied. In fact, past data on any type of event has been studied and a chart produced on the probabilities of that event and outcome playing out statistically again.

The data on what happens after a rate cut doesn't look too promising.

A rate cut should:

(i) weaken the USD

(ii) reduce the yield on a UST (increase the price).

Good for gold.

A weaker USD is inflationary. Stocks are inflationary hedges in as much as nominally they gain and in real terms they tend to stand still. Of course this depends very much on what the rate of inflation actually is.

Of course the rate cuts will help the Treasury reduce its level of interest payments on the compounding debt, fast approaching $36 Trillion. But what are we talking about in terms of cuts? 25bps, 50bps would be a bit of a panic inducing cut and 75bps could see a really bad reaction in the stock market as the message could be construed as very negative.

So the cut will not, in all likelihood, help Yellen and the Treasury that much. The Treasury to inflate the debt away will need much higher inflation (much weaker USD) to make inroads into the debt. That is assuming that tax revenues, almost 100% dependent on stock market returns, do not fall off (need a high and moving higher market) as government spending is increasingly crimped by the growing interest payments.

This is a sovereign debt crisis.

The only way that it stays afloat is through constantly rising asset prices.

How much higher can asset prices go (stocks, housing, bonds) when they are already exceeding historically nose bleed valuations and are in bubble territory?

The deficits will explode if UE rises. Hence the paranoia around this number and the BS numbers that are being generated each month.

Currently here in NZ post boxes are being robbed for anything of value, which if you are posting a letter, includes them stealing the stamps. Petrol driveoffs are out of control as are supermarket thefts. It is a sign of economic stress. Hardly the strong economy mooted by the politicians and their bureaucracy.

A friend of mine recently travelled the US and he goes pretty much every year, said that it is currently the worst that he has ever seen it for poverty and lawlessness.

Obviously you can't be short this market (only very selectively). The early August panic was very dangerous in that the whole BTD was massively reinforced. If we do see a bear collapse, the early stages will be perceived as another BTD, which then collapses lower.

So currently you must be long. You must be very alert to a bear collapse and be able to differentiate it from a BTD opportunity (which is why blogoland is parsing the data endlessly looking for the statistical answer) which is incredibly difficult this time around.

The last 2 big collapses, 2000 and 2008 were collapses of markets that were not initially perceived to effect damage on the government. Obviously once they realised their error, they jumped in.

This collapse is already recognised as threatening the stability (survival) of the government. Hence the interminable BS economic numbers. The constant bailouts of banks, well anyone that threatens a market collapse, constant new ways of adding liquidity while saying liquidity is being removed. The manipulations, distortions and fraud are at levels that are off the charts.

Shoot first, ask questions later.

jog on

duc