greggles

I'll be back!

- Joined

- 28 July 2004

- Posts

- 4,460

- Reactions

- 4,494

Lots of money to be made by picking the tops and bottoms of sectors. I did a search for a thread on this topic but couldn't find anything specific enough. There are threads on sector rotation and the next boom sector but I'm primarily interested in sector tops and bottoms to facilitate both short and long trades.

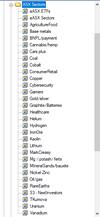

I mean sector in a very narrow sense. For example, in mining you can have the base metals sector or go one level narrower and discuss the copper sector. So sector in this sense just means an industry, no matter how narrow. BNPL, for example, is a sector in this narrow sense, even though it's arguably a subsector of retail. I just did a Google search and apparently these narrow subsectors are known as microsectors. You learn something new every day.

Taking a microsector approach expands the sector universe and also increases the possibility of more rapid share price movement as I think it's logical that microsectors can boom and bust faster than broad, larger sectors. This means a short or medium term approach can be employed depending on the type of sector you are interested in.

Anyway, the point of this thread is for anyone here to suggest that a sector or microsector is at or near a top or bottom and provide some reasoning for that position. Others can then either concur or disagree or perhaps even just suggest another sector that might be near a top or bottom. Hopefully some interesting discussion can be had.

I mean sector in a very narrow sense. For example, in mining you can have the base metals sector or go one level narrower and discuss the copper sector. So sector in this sense just means an industry, no matter how narrow. BNPL, for example, is a sector in this narrow sense, even though it's arguably a subsector of retail. I just did a Google search and apparently these narrow subsectors are known as microsectors. You learn something new every day.

Taking a microsector approach expands the sector universe and also increases the possibility of more rapid share price movement as I think it's logical that microsectors can boom and bust faster than broad, larger sectors. This means a short or medium term approach can be employed depending on the type of sector you are interested in.

Anyway, the point of this thread is for anyone here to suggest that a sector or microsector is at or near a top or bottom and provide some reasoning for that position. Others can then either concur or disagree or perhaps even just suggest another sector that might be near a top or bottom. Hopefully some interesting discussion can be had.