over9k

So I didn't tell my wife, but I...

- Joined

- 12 June 2020

- Posts

- 5,291

- Reactions

- 7,510

Important changes to CommSec trading limits

The limits on trades without a cash deposit are changing from 04 September 2021.

In light of recent market volatility, CommSec is changing trading limits to help protect our customers and minimise risk associated with investing and settlement.

What are the changes to trading limits?

From Saturday, 04 September 2021, the trading limit will be reduced to $5,000 for leading stocks. Non-leading stocks will be reduced to $1,000. Our current list of leading stocks can be found here (non-leading stocks are any stocks not included on this list).

One of the advantagese of commsec is that you can have $0 cash left and put orders sayingI see that CommSec has announced on 3 August that limits on trades without a cash deposit will be reduced from 4 September 2021.

Details aside, I do see it as potentially of relevance that the country's largest broker (at least they claim to be) is tightening up on risk management (from their own perspective) at this point in time.

My thinking isn't so much about what they're doing, the idea of requiring that someone actually has the $ to pay for the stocks they're buying doesn't seen an unreasonable concept to me, but it's more about what triggered the decision? What information do they have or what conclusions have they come to which lead them to take this action?

The details are on the CommSec site so worth looking for those who need to know.A pain..i am not aware of these restrictions but could just have missed them

Chamath Palihapitiya... He pops up from time to time when I'm researching various investments. He sells an almost perfect "American Dream" story: a son of immigrants who lived in poverty was abused as a child by an alcohol father and then made it big in Silicon Valley... Surprised he's not been referenced here more often (probably a good thing). In Australia we have those who always seem to make money off losing junior miners. In the US they have those who always seem to make money off losing tech.Well as i suspected... 2nd tier growth stocks (esp in US tech) are getting slaughtered. Some dropping 50% in a matter of days. E.g. Virgin Galactic.

Paradigms shift. New industries replace older ones. But no such thing as a free lunch. Valuations do matter eventually. Don't listen to sweet-talkers who ask you to take a leap of faith at prices 5x the price they bought in.

The 2 major snake oil salesmen currently is Cathie Woods and Chamanth Palihapitiya.

For those of you who don't know Cathie invests the $billions in her fund based on "what God asked her to" (LOL). Chamanth is the one who bought a whole bunch of speculative garbage like SPCE and went on CNBC telling people to buy his favored stocks at 5x the price he bought in. These days he's dumping his shares and saying he's "re-investing the money into the fighting climate change" (LOL). Nobody can see through that excuse.

Virgin Galactic drops 10% after chairman Chamath Palihapitiya dumps his $213 million personal stake

Virgin Galactic Chairman Chamath Palihapitiya sold his remaining personal stake in the space tourism company earlier this week.www.cnbc.com

Absolute dirty market manipulating scumbags. They should both be locked up for life imo for misleading 10s of thousands of investors. But hey wishful thinking as business people like them never do.

I'm sure he invested in Tesla and sold at the heights last year. I watch a lot of his youtube stuff as he has some interesting insights.Chamath Palihapitiya... He pops up from time to time when I'm researching various investments. He sells an almost perfect "American Dream" story: a son of immigrants who lived in poverty was abused as a child by an alcohol father and then made it big in Silicon Valley... Surprised he's not been referenced here more often (probably a good thing). In Australia we have those who always seem to make money off losing junior miners. In the US they have those who always seem to make money off losing tech.

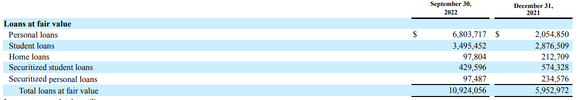

To my knowledge (which is really Wikipedia's knowledge?) he's been involved with 4 companies listing. Virgin Galactic, Opendoor (online realestate), clover health (health insurance), and sofi (share trading/personal finance). Chart below. sofi is the only thing which has not completely collapsed, and sofi's loanbook... I certainly wouldn't want to be investing in a company which has 90% of its loans listed as 'student' and 'personal' especially since most are assuming the US economy is going to struggle for the next 12 months (if not longer)

View attachment 150926

View attachment 150927

it seems the funny money is chasing the stories, rather than the results.. probably based on lower interest ratesI can hear the last gasps of the equities market bull and believe that the top of the market is just about in. The recent bullish gold and silver price has confirmed this view for me. I don't think that there is any more bullish fuel left and as the real state of the US economy comes into sharp focus I think the real selling will begin and the bears will take control of the market.

High interest rates, sticky inflation, an unprecedented amount of public and private debt that is increasing at unsustainable levels, commercial and residential property markets in decline, retail spending in the toilet and personal and business insolvencies on the increase.

Western Europe, the UK and Australia are in a similar economic position. China is looking very shaky and there is war and heightened geopolitical tensions around the world.

... lots of headwindsThe short to medium term economic future looks grim

Lots out there chasing the narrative of rate cuts but barely a Financial Professional under 40 has lived in a true rate cut cycle and it's a careful what you wish for scenario . The " pivot " crew is convinced rate cuts fuel a super bull , not much precedent supporting this view . A 40yr downtrend in Bond Yields has been broken . A paradigm shift that many are failing to recognize leave alone grasp . Timing market tops is much harder than lows . Tops are a process whereas lows are an " event " . Price is king , follow price , it's dynamic . Day/short term traders are going to be the kings of alpha once the top is finally printed . If/when a bear starts it's going to be a slow motion one to begin with . DYOR and good luck to allit seems the funny money is chasing the stories, rather than the results.. probably based on lower interest rates

View attachment 177244

... lots of headwinds

Election Day is just one week away, and the outcome is set to have wide-ranging consequences for markets regardless of who wins the White House or which party controls each chamber of Congress. Stocks are uncharacteristically strong heading into the U.S. presidential election on Nov. 5, with all three major averages at or near all-time highs even in the face of rising Treasury yields. On Tuesday, the Nasdaq Composite index notched a new record for the second time in three days. But either way the results fall on Nov. 5 has the potential to roil markets — especially after an exceptionally tight race between former President Donald Trump and Vice President Kamala Harris, according to the latest NBC News poll . “No matter how the election results come in, it’s certain that there will be lasting effects for both U.S. and global markets,” Mike Mullaney, director of global markets research at Boston Partners, wrote in a recent paper. The candidates’ policies could hardly be more different.

Trump has promised expansive tax cuts for companies and individuals, in addition to stepped up tariffs and a mass deportation of illegal immigrants. Harris has promised higher taxes on corporations and the rich, and expansions of housing and health care spending. Both, however, would implement policies that raise what is already a yawning budget deficit. It’s a concern perhaps picked up by bond investors, who briefly drove the yield on the benchmark U.S. 10-year Treasury near 4.34% on Tuesday. Here is how stocks might react to a variety of outcomes. A Trump win, with or without a Republican sweep A Trump victory, with an uncontested Republican sweep of Congress, is projected to be a bullish development for equities. It’s an outcome that markets appear to already be pricing in . Not only are the three major stock averages at or near all-time highs, the outperformance of banks in particular points to further cyclical leadership in the event that Trump wins the November election. The SPDR S & P Regional Banking ETF (KRE) has jumped nearly 5% since the fourth quarter began on Oct. 1, while the S & P 500 is ahead a little more than 1%. Julian Emanuel, senior managing director leading the equity, derivatives, and quantitative strategy team at Evercore ISI, expects the vote could lead to a ”‘performance chase’ meltup” that pushes the S & P 500 over 6,000 after the election, and close to 6,300 by year-end.

Other market observers also expect a Republican sweep will be bullish for equities. “If you do get Trump in a Red Sweep, you’re going to get this cyclical pile-on,” Warren Pies, 3Fourteen Research co-founder, told CNBC’s ” Closing Bell ” on Friday. The market “could have indigestion” at first blush, “and then all of a sudden everyone realizes, yeah, but nominal GDP is going to be really strong. So, let’s buy this market,” he said. In the event of a Trump win but with a divided Congress, the S & P 500 is likely to remain flat in the days following the election, Emanuel wrote. However, this case has the highest likelihood of a “market meltup” scenario, in which the S & P 500 could soar above 6,450 during what are already the seasonally strong months of November and December. A Harris win, with or without a Democratic sweep A Harris victory, including a sweep of both the House of Representatives and Senate, is expected to act as a negative surprise for markets in the days after the Nov. 5 election. Evercore ISI expects the S & P 500 falling in the 10 days after the election, to roughly 5,700, as markets re-price their expectations. But even under this scenario, the broad market index is still seen surging to close to 6,200 by the end of the year. “I think you could get an after-election opportunity to put money to work,” Jeff Schulze, head of economic and market strategy at ClearBridge Investments, said during a media webcast last week. 3Fourteen Research co-founder Pies expects a Harris win would translate into a drop in cyclical and small-cap stocks, and spur investors to turn to high-quality tech names. He expects bond yields could come off their highs. However, a Harris win, with a split Congress, is an outcome that could spur a drop in the S & P 500 immediately after the election, down to about 5,525, according to Evercore ISI. In this outcome, the S & P 500 could end the year little changed from where it is now if the election results are only lightly contested, or slide to maybe 5,675 if the results are highly contested and there’s a threatened disruption to the transfer of power in January, Evercore ISI’s Emanuel said.

Yeah, not much worse than being priced out of the market when you need to get back in but if you need to preserve capital it's your only choice.Buffett Calls The Top: Berkshire Dumps 100 Million Apple Shares As Unprecedented Selling Spree Boosts Cash To Record $325 Billion Dollars | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

View attachment 187286 www.zerohedge.com

the ZeroHedge version

the problem for me is , if i sell down a lot , where do you park it

several stocks i would like to buy would need to drop more than 60% to be attractive

betting on a 60% plus plummet ( in the stocks you want ) is a bit of a gamble , when the market goes crazy over a 40% drop ( and the government is liable to step in and 'pick winners ' aka loans/grants/contracts )

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.