- Joined

- 14 December 2010

- Posts

- 3,472

- Reactions

- 248

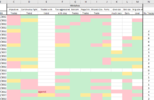

I created a basic excel spreadsheet.Did/do you (or anyone else?) ever use any commercial journaling tools. There seems to be some good products out there but not sure if it'll be worth it. I've been doing my own but not as flash as commercial ones. They would give a deeper insight into stats i guess.

I think it gives me enough.