Re: OIL AGAIN!

yes, your right... lucky for me Correction is warranted... but overall long trend is bullish... a pullback to $100 - $115 would be great buying... It wouldn't suprise me to see a drop to $100 so the institutions can load up.

Correction is warranted... but overall long trend is bullish... a pullback to $100 - $115 would be great buying... It wouldn't suprise me to see a drop to $100 so the institutions can load up.

That rebound, mmmm I think it has more to do with options expiration... but now that is out of the way, we shall see.

Lucky it's not three strikes and you are out!

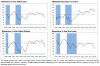

Presently the oil market is being well bought into on price weakness, as evidenced by a dip into the low $120s during the week that was very, very shortlived.

It shows that oil's "bullishness" is not yet exhausted in the short term, although a correction is warranted.

yes, your right... lucky for me

That rebound, mmmm I think it has more to do with options expiration... but now that is out of the way, we shall see.