- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

Re: OIL AGAIN!

The cynics amongst us would put 2 + 2 together and come up with a US President with a history in oil, and possibly a vested interest in keeping the oil price high. Would a bunch of not so faceless men use the resources of the military (at no cost to themselves, in fact making billions in the process) and the lives of their fellow countrymen to wage a war so they could get rich? I haven't heard of a valid reason for the invasion of Iraq so far?? They just can't be so silly, or greedy - can they???

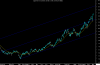

So far, the increase in the average price of oil is only? showing up in lower company profits & higher inflation. 110 was starting to hurt and brought on food riots; if the effect of the increasing price of oil is exponential there will be severe collateral damage to the global economy long before it reaches $200.

Oil just needs the FWs to stop invading countries that hold major percentages of the worlds oil and gas reserves .

A simple change in law by Congress with regards to retaliatory powers of a President would have saved the USA billions of dollars . Left 13% of the globes reserves operating and could have had a ceiling for oil placed in the $80's .

Now they will end up with higher welfare payments at a time they needed to restructure them . All in the name of oil .

If we want to really know what oil is going to do , we just need to follow certain countries policies and their administrations agendas .

The cynics amongst us would put 2 + 2 together and come up with a US President with a history in oil, and possibly a vested interest in keeping the oil price high. Would a bunch of not so faceless men use the resources of the military (at no cost to themselves, in fact making billions in the process) and the lives of their fellow countrymen to wage a war so they could get rich? I haven't heard of a valid reason for the invasion of Iraq so far?? They just can't be so silly, or greedy - can they???

So far, the increase in the average price of oil is only? showing up in lower company profits & higher inflation. 110 was starting to hurt and brought on food riots; if the effect of the increasing price of oil is exponential there will be severe collateral damage to the global economy long before it reaches $200.