- Joined

- 29 January 2006

- Posts

- 7,218

- Reactions

- 4,443

As you note, the low hanging fruit has been picked.Biggest problem with peak oil is that the concept is almost universally misunderstood. (Not having a go at you or anyone there, just noting it).

Common perception is that it means we're running out of oil or that prices are going to the moon. In reality the actual basis behind it is far simpler.

Pick any resource from land to timber to dam sites to oil and humans pick the low hanging fruit first.

Go to pretty much any city in the world and you'll find that the oldest part is that closest to the center. If you're looking for the oldest building then it generally won't be 50km away in the outer suburbs and if by sheer chance it is, then that building won't have been part of the city at the time but was a farmhouse etc which only became part of the urban area a long time after it was built.

Now find the oldest dams built for water supply. They'll be the sites closest to the city center almost always. Nobody builds a dam 200km away if they can build one in the hills next to the city.

And so on. Pick any resource and it's what humans do.

Same with oil.

The first wells were shallow, onshore and not far from existing cities and towns. In other words, the simplest, easiest, cheapest options available. Then as those run out, progressively further away, deeper or more technically difficult sources were developed.

That being so, with any resource that's working down the list of available options the cost inevitably rises. More materials, more labour, greater technical challenges and it's further away. The fundamental costs of developing each new source are higher than the best, now already used, one that came before it.

Same goes for things like environmental conservation or war zones and so on. Nobody's going to come up with a plan to drill in a National Park or set up operations in a war zone if there's a far less contentious and safer option sitting right in front of them that's dead easy. Such ideas only make business sense if there's no better option.

The "peak oil" theory is simply that as cost rises over time, a point would logically come where consumers can no longer afford increasing consumption and sometime after that, as cost continues to rise even further, consumption rolls over. That maybe either because the higher price prompts the development of alternatives or simply because it's unaffordable as such - if it cost $1000 per barrel then I think we all agree there'd be a drop in use.

So where are we then?

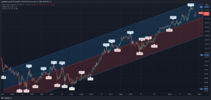

Looking at inflation-adjusted oil prices in USD, to the extent there's a "normal" price for oil it's between $20 and $30 per barrel. Excluding wars, sanctions, embargos and so on then prior to the year 2000 the industry was consistently able to operate profitably with prices in that range. Highly profitably in fact.

If we're not seeing companies excited at the prospect of $30 oil well that says all you need to know really. It says that the options available today aren't as good as the ones available previously. In truth well even at double that, $60, there was no great rush of drilling.

I'm no doomer and there's still plenty of oil on the planet but the evidence does point to it being past its economic best. The price required to make drilling viable has increased on a per barrel extracted basis despite improvements in technology. Prices that would have seen a flurry of drilling in the past don't prompt that response these days, the available options just aren't so good.

The other aspect affecting exploration is the willingness of financiers to risk lending to drillers when success rates decrease and new finds don't have the volumes to be profitable given the volatility of oil prices in the market.

Another way of putting it is that there are much safer bets for financiers nowadays.

That also has a flow-on effect to investors who are less willing to pour into oil companies, thereby deflating stock prices.

And all this in an environment where FF industries are increasingly problematic due to climate change concerns.