- Joined

- 14 February 2005

- Posts

- 15,387

- Reactions

- 17,803

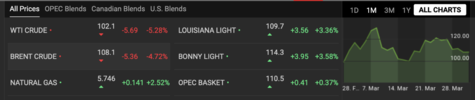

Agreed but realistically it's more than any other single measure is likely to do in practice.The US release of strategic reserves is SOOOOOO insignificant to the daily US or global current supply/demand.it will have a blip of affect on the oil price.

1 million barrels per day from the SPR for six months seems to be what they're suggesting.

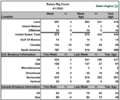

Versus 0.432 million barrels per day just announced by OPEC (and not really a new announcement anyway) with the reality that in recent times OPEC has underdelivered on output hikes so the real increase will likely be somewhat less.

A related issue with OPEC is that of spare capacity and how much they can really produce? There'd be few if any people on the planet who know the actual truth there as a whole given that OPEC itself can really only take its own members' word for it and nobody audits this stuff.

What can be said though is that looking at recent data, a number of OPEC members are failing to meet quotas which suggests they're maxed out so far as their actual usable production is concerned. Not all, there's some that are doing it so clearly have had spare, but some are struggling.