- Joined

- 24 December 2005

- Posts

- 2,601

- Reactions

- 2,065

After looking at my chart this weekend I agree with you Rob. I have been fiddling with volumes as an indicator of future price direction. When there is high volume at either the top or bottom of the price it appears to cause a reversal in the price. I am looking at this concept closely. I see the identical thing on gold this week as well. Perhaps gold and oil are now in for a spell of falling prices. I see a massive volume spike at the bottom price of the S&P 500. I am wondering if this is going to be a total reversal for the stock market or just a dead cat bounce for the S&P et al?A fall back to support is more likely in the medium term unless things in eastern Europe flare up.

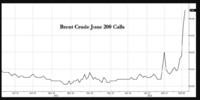

...Or unless Putin decides to dump shiploads of oil at whatever price he decides is fair. I think he mentioned $70 to $80 ( I think, could be wrong). China appears to be willing to trade with Russia, correct me if I am wrong but I think China is a massive consumer of oil and would potentially influence the price if they traded with Russia at an agreed price of say $75. It is all very interesting.So if Russian exports were to stop then we get some combination of inventory drawdown and price rising to the point where it kills demand. At least we do unless someone's sitting on more spare capacity than is generally accepted to be the case and is willing to use it.