- Joined

- 29 January 2006

- Posts

- 7,217

- Reactions

- 4,438

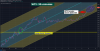

Too high too fast...

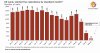

Here's what the US LTO producer's need to get oil back into production:

For the sake of simplicity, I think I will use $30 as the magic minimum for LTO when assessing the earliest any players are likely to return to drilling.

In reality an average of $50/bbl is required for the US oil industry to break even, so the margin of overall debt to be suffered until we get back there is massive.

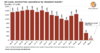

Here's what the US LTO producer's need to get oil back into production:

For the sake of simplicity, I think I will use $30 as the magic minimum for LTO when assessing the earliest any players are likely to return to drilling.

In reality an average of $50/bbl is required for the US oil industry to break even, so the margin of overall debt to be suffered until we get back there is massive.