- Joined

- 29 January 2006

- Posts

- 7,228

- Reactions

- 4,476

I think you missed the number "1" above - yes, at 1% nickel WSA will not be as profitable as previously. However, its contained nickel pipeline gives it a long life cycle and over a decade of further exploration to add to its resource base:

IGO's offer was never generous as it barely incorporated the hundreds of millions WSA already spent to get to its new growth pipelines, and about $150 million in cash reserves (ie., about 45cps).

IGO's offer was never generous as it barely incorporated the hundreds of millions WSA already spent to get to its new growth pipelines, and about $150 million in cash reserves (ie., about 45cps).

greggles

I'll be back!

- Joined

- 28 July 2004

- Posts

- 4,522

- Reactions

- 4,678

Nickel facing a liquidity crisis as trading volumes collapse on the LME.

www.mining.com

www.mining.com

The LME has lost a lot of credibility over this nickel short squeeze. How can large players confidently hedge metal price risk with an exchange that arbitrarily cancels trades?

Nickel paralysis deepens as battered LME market barely trades

The market has remained in near-paralysis, even on days when prices have been trading within the 15% daily limit.

The LME has lost a lot of credibility over this nickel short squeeze. How can large players confidently hedge metal price risk with an exchange that arbitrarily cancels trades?

- Joined

- 3 July 2009

- Posts

- 28,308

- Reactions

- 25,648

I would think buyers will have to lock in log term supply contracts, with reliable suppliers.Nickel facing a liquidity crisis as trading volumes collapse on the LME.

Nickel paralysis deepens as battered LME market barely trades

The market has remained in near-paralysis, even on days when prices have been trading within the 15% daily limit.www.mining.com

The LME has lost a lot of credibility over this nickel short squeeze. How can large players confidently hedge metal price risk with an exchange that arbitrarily cancels trades?

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,721

- Reactions

- 12,462

Nickel looks like it's stabilising a little, but well above the prices before the short squeeze. You'd expect it to go back to the 25K mark at some stage, unless something fundamental has happened in the market. Is the Russia sanctions and less supply going to change the price longer term? What price does a company doing a DFS on a nickel mine plug into the spreadsheet? At the moment the range is $25K to $35K, but a company like CTM had a number way down around $15K for their scoping study. I suppose it depends on what they could reasonably get in an off-take agreement. How much will Elon pay I wonder.

- Joined

- 29 January 2006

- Posts

- 7,228

- Reactions

- 4,476

This is a must read for anyone investing in mining companies.

Specifically related to nickel, it says:

While I think the Quarterly report from the Chief Economist is on the money here, I reckon their EV outlook is significantly off.

Bottom line here is that the continuing incremental increased demand for BEV nickel is likely to keep nickel prices elevated until a better battery technology takes it place in terms of energy density.

Specifically related to nickel, it says:

While I think the Quarterly report from the Chief Economist is on the money here, I reckon their EV outlook is significantly off.

Bottom line here is that the continuing incremental increased demand for BEV nickel is likely to keep nickel prices elevated until a better battery technology takes it place in terms of energy density.

- Joined

- 3 July 2009

- Posts

- 28,308

- Reactions

- 25,648

Nickel has finally settled down, which IMO is good for the industry, having crazy swings causes a loss of confidence.

www.mining.com

www.mining.com

Nickel price back to where it started before March chaos

Nickel futures finally tumbled back below the level where the London Metal Exchange market closed March 4.

- Joined

- 29 January 2006

- Posts

- 7,228

- Reactions

- 4,476

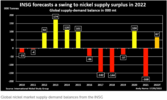

Column: Nickel demand boomed in 2021; this year it will be supply

Headlines are interesting things, and this one is backed by some good data. The problem is the assumptions underlying it: are they sound?The INSG does not actually have the best record of getting its numbers right, despite being the principal nickel industry commentator:

So here we are 5 months into 2022 and LME + SFE warehouses have a grand total of 63500 tonnes available, and have not shown any signs of inventory build of substance this year.

Indonesia is leading the supply side response, but largely via nickel pig iron. It will send its nickel matte and MHP to China for further processing to be suitable for BEVs.

Problematic in the INSG's forecast is how China, which fell away in stainless output last year, might bounce back. That said, given covid lockdowns to date, it's unlikely China's 2022 numbers will look as impressive as last years. While on the other hand the rest of the world grew stainless production by over 20% in 2021. Just maintaining that increase dents the INSG's forecast, while a further increase cannot be ruled out, notwithstanding the disruptions from Ukraine.

But the real issue is how BEV numbers are consistently and significantly above forecasts, potentially nullifying INSG's 2022 supply surplus. And a possibly hidden factor is if the many planned and soon to be in production ternary battery gigafactories have already locked in supply so they they don't get caught short. If that's the case then we are likely to see a another deficit in 2022.

- Joined

- 3 July 2009

- Posts

- 28,308

- Reactions

- 25,648

A good article on nickel, for those interested.

www.abc.net.au

www.abc.net.au

Why miners are racing to produce one of the world's most in-demand metals

Nickel is a critical metal in batteries, and the world's miners are struggling to keep up with booming demand as consumers switch to renewables.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,721

- Reactions

- 12,462

BHP are clearly trying to consolidate in the Cu and Ni space and they seem pretty light on for Ni compared to other commods. Only $0.4bn compared to IO $21b and Cu $8.6b. I don't think West Musgrave will be the end of their adventures into Ni. I'm expecting CTM to be one of the projects of sufficient scale that BHP could go after. I thought OZL actually would as they operate in the region of the future CTM mine. It'll have about a 25 year mine life so could fit the bill. I'm hoping for something like that anyway.

JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 4,615

- Reactions

- 6,841

Tesla may have started a Nickel rush amongst vehicle manufacturers -

Tesla needs nickel to dominate the car industry. It just signed a $5 billion deal with the metal’s largest source

If Elon Musk wants to sell 20 million cars a year by 2030, he’ll need a lot of nickel—a key metal used in the electric batteries that power Tesla cars. And now, after years of wooing, the largest source of the metal seems to have won the Tesla CEO over.

On Monday, an Indonesian cabinet minister told CNBC Indonesia that Tesla had agreed to buy $5 billion worth of nickel products from the Southeast Asian country over the next five years. Indonesia is the world’s biggest source of nickel, with about 23.7% of the world’s reserves, according to the U.S. Geological Survey. (The U.S. imports most of its nickel—which is also used to make alloys like stainless steel—from Canada, Norway, Finland, and Australia).....

- Joined

- 3 May 2019

- Posts

- 6,398

- Reactions

- 10,158

- Joined

- 8 June 2008

- Posts

- 13,751

- Reactions

- 20,539

Us market closed so could it be JP Morgan and friends are not suppressing the market today?

- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,897

Always a small chance of something like this happening again.

www.firstlinks.com.au

www.firstlinks.com.au

www.afr.com

www.afr.com

50 years ago, Poseidon made today's WAAAX look waned

If you think those darlings of the ASX, the WAAAX stocks, have the most spectacular valuation excesses, how about 80 cents to $280 in a few months? Poseidon was the biggest of all, and we don't learn the lessons.

50 years after Poseidon, big nickel is back

The electric car boom has brought a new buzz around nickel, reviving memories of a global investment sensation that took place two years before Elon Musk was even born, writes Brad Thompson.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,721

- Reactions

- 12,462

Always a small chance of something like this happening again.

50 years ago, Poseidon made today's WAAAX look waned

If you think those darlings of the ASX, the WAAAX stocks, have the most spectacular valuation excesses, how about 80 cents to $280 in a few months? Poseidon was the biggest of all, and we don't learn the lessons.www.firstlinks.com.au

50 years after Poseidon, big nickel is back

The electric car boom has brought a new buzz around nickel, reviving memories of a global investment sensation that took place two years before Elon Musk was even born, writes Brad Thompson.www.afr.com

Yes, but are the circumstances the same? Poseidon 40c to $280... Haven't seen that yet.

Not sure what the fundamentals were on nickel back then.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,721

- Reactions

- 12,462

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,721

- Reactions

- 12,462

Agreed @Sean K . I was aware of the rally in my nickel position (NIC). Should have looked at the nickel price.

This is a chart of the nickel ETN - JJN that reflects the price rally.

View attachment 149685

It's quickly dropped back to $25Kt the last few days but that still means companies like CHN, with 2Mt of contained NiEq, and CTM with 1Mt Ni, have about $50b and $25b of $$ in the ground.

JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 4,615

- Reactions

- 6,841

A traditionally "spiky" commodity could be Tasmania's ticket into a booming industry, according to the general manager of the state's first and only nickel mine.

The Avebury Nickel Mine, about 10 kilometres from Zeehan on Tasmania's West Coast, reopened and began producing in September after sitting in care and maintenance for 13 years.

Good afternoon

Nice succinct article written by Garimpeiro’ columnist Barry FitzGerald yesterday (10/12/22), about Nickel and some nickel stocks to watch in coming months.

stockhead.com.au

stockhead.com.au

Not holding ASO, NIS or NNL. Kindly conduct your own due diligence.

Have a safe and happy Christmas and prosperous new year.

Kind regards

rcw1

Nice succinct article written by Garimpeiro’ columnist Barry FitzGerald yesterday (10/12/22), about Nickel and some nickel stocks to watch in coming months.

Barry FitzGerald: Lithium is dead; long live these nickel juniors in 2023 - Stockhead

Nickel supply needs to increase four-fold over the next 30 years if energy transition targets are to be met.

Not holding ASO, NIS or NNL. Kindly conduct your own due diligence.

Have a safe and happy Christmas and prosperous new year.

Kind regards

rcw1

Similar threads

- Replies

- 5

- Views

- 3K