- Joined

- 3 July 2009

- Posts

- 27,638

- Reactions

- 24,526

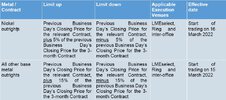

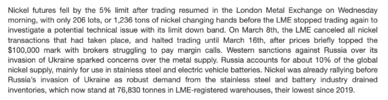

London Metal Exchange to start trading nickel again, apparently measures have been put in place to control price swings, including reporting trades of more than 600T and where the material is sourced from and limits on daily price movements.

High quality known reserves should benefit IMO, it sounds as though there is way too many smoke and mirrors trades going on.

apnews.com

From the article:

apnews.com

From the article:

LONDON (AP) — The London Metal Exchange plans to resume trading in nickel, a week after it was suspended when the price of the metal surged to over $100,000 a ton.

Trading will resume at 8 a.m. London time on Wednesday, the LME said in a statement, saying a major market client had confirmed it had gained support from banks that might forestall further “disorderly conditions.”

That followed an announcement Monday by Tsingshan Holding Group, a Chinese metals giant, that it had struck a deal with a consortium of its creditors on a “standstill arrangement.” It said the banks agreed not to make margin calls or close out their positions against Tsingshan while the company is resolving its nickel margin and settlement requirements.

“As an integral feature of the agreement, there is provision for the existing hedge positions to be reduced by the Tsingshan group in a fair and orderly manner as abnormal market conditions subside,” it said.

Before trading was suspended, nickel prices had quadrupled in a week amid widening and severe economic sanctions against Russia for its invasion of Ukraine.

The LME said it would specify precise levels for daily price fluctuations later Tuesday.

Prices for copper, zinc and aluminum have fallen this week along with the price of oil and other commodities.

High quality known reserves should benefit IMO, it sounds as though there is way too many smoke and mirrors trades going on.

London Metal Exchange to resume nickel trade

LONDON (AP) — The London Metal Exchange plans to resume trading in nickel, a week after it was suspended when the price of the metal surged to over $100,000 a ton.

LONDON (AP) — The London Metal Exchange plans to resume trading in nickel, a week after it was suspended when the price of the metal surged to over $100,000 a ton.

Trading will resume at 8 a.m. London time on Wednesday, the LME said in a statement, saying a major market client had confirmed it had gained support from banks that might forestall further “disorderly conditions.”

That followed an announcement Monday by Tsingshan Holding Group, a Chinese metals giant, that it had struck a deal with a consortium of its creditors on a “standstill arrangement.” It said the banks agreed not to make margin calls or close out their positions against Tsingshan while the company is resolving its nickel margin and settlement requirements.

“As an integral feature of the agreement, there is provision for the existing hedge positions to be reduced by the Tsingshan group in a fair and orderly manner as abnormal market conditions subside,” it said.

Before trading was suspended, nickel prices had quadrupled in a week amid widening and severe economic sanctions against Russia for its invasion of Ukraine.

The LME said it would specify precise levels for daily price fluctuations later Tuesday.

Prices for copper, zinc and aluminum have fallen this week along with the price of oil and other commodities.