- Joined

- 24 December 2005

- Posts

- 2,601

- Reactions

- 2,071

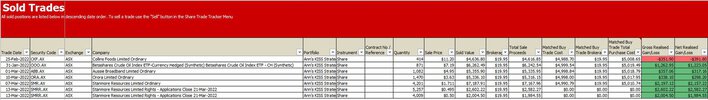

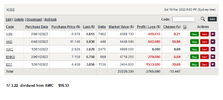

Let's look at how KISS did this week, sold two companies, made some reasonable $$$ along the way. The first I will talk about is ORA which I sold for $3.63 on Thursday. Again I am trading using volume spikes as a guide. There was a volume spike halfway down a fall. Generally, I am seeing after the fall, the recovery only comes up to the V spike horizontal level or slightly above before it falls back. I took the opportunity to sell even though I only managed an extremely meagre % increase of 6.32%. I felt it prudent to sell under current conditions as I doubt a packaging company will set investors on fire enough to want to buy above a double top. Could be wrong of course. However, a small profit is better than a loss. If I lose some upside....gosh, I will just have to suck it up!

My other sale of the week was SMR and the renounceable rights attached on Tuesday after the Monday ex-rights date. There was an offer of 7 rights for every 3 shares held. I sold the company and then half the rights. I decided I was a dill to hold half the rights and sold the second half immediately just holding back about 530ish RRs, enough for a marketable parcel which would give me access to the rights of a share purchase of $1.10 ps and there is also the opportunity to apply for more shares over the number of rights held, so I will apply for another 4000 shares which are also available for $1.10 and it does not attract any brokerage of course. So I was able to realize a 134.70% gain from the combination of the renounceable rights and company sale and hopefully regain my holding of around $5000 of SMR again after I take up my rights and apply for the extra company shares.

My other sale of the week was SMR and the renounceable rights attached on Tuesday after the Monday ex-rights date. There was an offer of 7 rights for every 3 shares held. I sold the company and then half the rights. I decided I was a dill to hold half the rights and sold the second half immediately just holding back about 530ish RRs, enough for a marketable parcel which would give me access to the rights of a share purchase of $1.10 ps and there is also the opportunity to apply for more shares over the number of rights held, so I will apply for another 4000 shares which are also available for $1.10 and it does not attract any brokerage of course. So I was able to realize a 134.70% gain from the combination of the renounceable rights and company sale and hopefully regain my holding of around $5000 of SMR again after I take up my rights and apply for the extra company shares.